“The real troubles in your life, Are apt to be things that never crossed your worried mind. The kind that blindsides you at 4 p.m. on some idle Tuesday”

Everybody’s Free by Baz Luhrmann

In the first chapter of the Bhagavad Gita, titled “Arjuna Vishada Yoga” or “The Yoga of Arjuna’s Dejection,” Arjuna faces deep inner turmoil on the battlefield of Kurukshetra. As the great war is about to begin, Arjuna, a warrior prince and a key figure in the epic Mahabharata, is filled with doubt, moral dilemmas, and emotional distress. The start of the year 2023 seemed to be a bit like that. Markets and commentators were in turmoil regarding the dilemma that the Fed’s faced. Would the Fed tilt towards growth finally or would it still be about rates and inflation? The mood was one of dejection. In January 2023, Hindenburg hit the markets with their report on the Adani Group. In March markets grappled with the failure of Silicon Valley Bank and the danger of other regional banks going belly up in the US. Things seemed to be going from bad to worse. The Fed stepped in and guaranteed that all depositors would be paid in full. With that, the climax of the crisis seemed to be over. There were other ramifications as most feared that this action may have undone the impact of the rate hikes as it pushed liquidity back into the system. However inflation seemed to be slowing down, but not the economy nor the unemployment rate. So the Fed didn’t have to reverse its hawkish stance and rate hike program. War continues in Ukraine but it hardly makes any news anymore. Against this backdrop, in the first six months of CY 2023, the Nifty is up about 9%, the S&P 500 is up 12% and the Nasdaq is up a whopping 22%. So what has changed?

Inflation is slowing down and the rate hike cycle seems to be coming to an end. There may be a long pause with a few token 25 bps hikes but the Fed has managed to go from 0% interest rates to about 5% in a year and a half with one accident i.e. the SVB failure but has not yet broken the economy or pushed it into a recession yet. Most are still calling for a recession, but if 2008 has taught has anything, it is that markets are a complex adaptive system. They adapt and react. The outcomes of actions are not always the same.

At this point, markets seem to be concerned about valuations being high in certain pockets and in the fair zone for the market. China is seeing deflation and that could be an accident waiting to happen. Oil is on the boil, the USDINR is currently constantly bobbing its head about Rs.83

However in the long run this is all noise. We have to accept that once in a decade we will see 20-30% corrections. In fact, since 1991 we have seen 7 corrections or falls greater than 20%. So about 1 every 4 years. We have been through many major crises, most recently the pandemic and minor (in hindsight) crises like the SVB failure and now we are still unable to decide whether China will collapse and along with it drag the world into turmoil.

Currently, the concern about India is that it is valued at about 1 standard deviation above its long-term average. This may be because of some underlying reasons to do with India being viewed as positioned to deliver strong earnings growth relative to other economies. Also, volatility has dropped considerably which makes India a defensive low-beta bet.

Whether this continues is anyone guess. What we do know is that we will be following our systems and processes to protect capital and capitalise on trends as they happen.

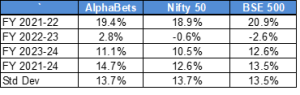

Performance

This was a great quarter for equities especially in the mid and small cap segment. July 23 however saw one of the largest gains in the portfolio of 7.5% vs about 3.9% for the benchmark. The data below for FY 23-24 is up to June 2023 quarter.

Stay safe and take care. Thank you for investing with us.

Regards,

Anish Teli and QED Capital Team, August 2023

To know more about our investment philosophy and strategies, please share your details on https://qedcap.com/contact/

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.