Dear Investors,

In this year’s annual letter, we look at the impact of increasing financialization of savings in India (movement from investments in real estate and gold to investment in financial instruments like mutual funds, sovereign gold bonds etc.) and how the edge in traditional fundamental investing is being eroded by the “paradox of skill”.

Usually there are three pockets of inefficiencies in markets – diversity of participants, institutions competing with individuals and trading with distressed counterparties. In this letter we look at the second pocket in greater detail. The key to any attractive endeavour is where the players have varying degrees of skill and the skillful players benefit at the expense of the less skilled players.

Paradox of Skill

Michael Mauboussin, Head of consilient research at Counterpoint Global, calls the ‘paradox of skill’ — a phenomenon in which shorter-term outcomes become more random or prone to luck as the absolute skill levels of the talent pool continue to rise while the relative skill levels narrow. He says he learnt this phrase from the late biologist Stephen Jay Gould. The concept applies to any domain, including business and sports, and considers skill on an absolute and relative basis. The paradox of skill is quite evident in sports. The batting average that Hall of Fame baseball player Ted Williams achieved many years ago is even harder to repeat today, according to Mauboussin. Williams, a Boston Red Sox player, was the last player in major league baseball to hit over .400 in a season — which he achieved in 1941. Data from the English Football League shows that the number of matches ending in a draw has more than doubled over a century despite rules being changed to keep the sport more competitive and exciting. This is because the overall skill levels have risen with the improvement in coaching facilities, amenities, support staff, analytics, and so on. We see this phenomenon in the IPL in many matches. A player can sometimes get 29 runs off 6 balls and sometimes fail to get 2 runs off the last ball. The outcomes can be quite random, and a few balls can be the difference between winning and losing the game. The paradox of skill is now becoming evident in the investing arena too. Take a cue from Warren Buffett when he says, “If you’ve been in the card game 30 minutes and you can’t figure out who the patsy is, you’re the patsy.”

The other side

Let us take a step back and understand the landscape. Data shows that retail investors are exiting the direct equity route and now most of the time, the person on the other side of a fund manager’s trade is another equally smart fund manager.

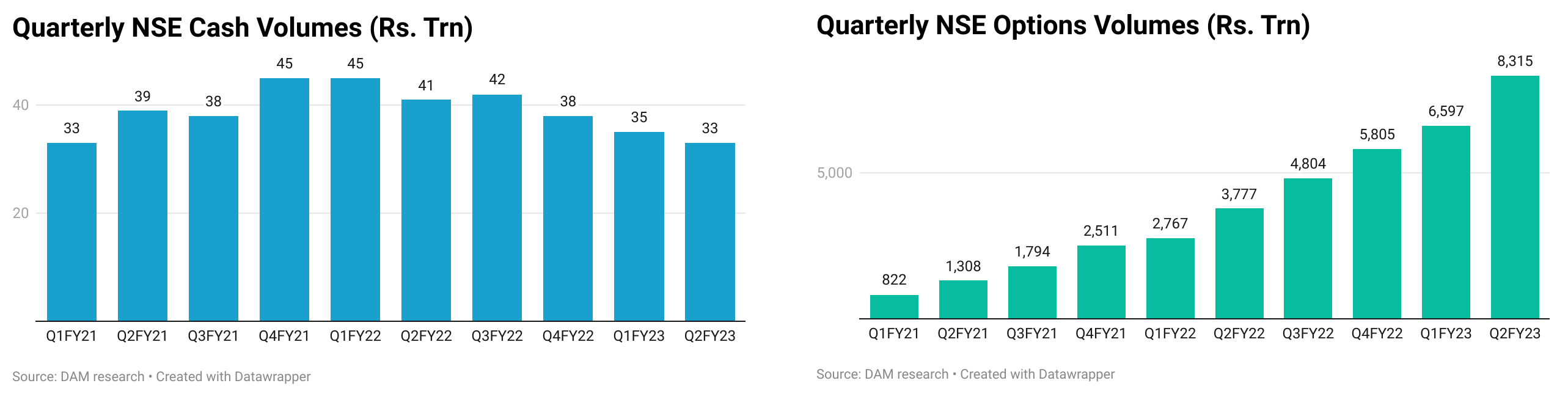

Most individual retail investors have increased their activity in the derivatives market in India, especially in the options segment. Covid and WFH were the initial drivers but the more important reason is the cap on intraday leverage that can be provided by brokers has severely hit retail cash market volumes.

Also as a result of the increasing financialization of savings, SIP (Systematic Investment Plans) inflow numbers have grown steadily and are robust amid all doom and gloom. Participation in equity mutual funds through SIPs has risen to an annualized run rate of $20 billion, making the domestic retail investor the largest public participant in the markets, bigger than foreign investors, whose actions had previously determined market direction for years.

What is the impact of retail investors exiting the cash market and why does it matter who is on the other side of a trade?

In the 1990s, quantitative investor, Renaissance Technologies’ Medallion fund (still one of the most profitable funds in the world) was emerging as a big winner in most of its trades. While its founder and famous mathematician Jim Simons was happy, a thought kept on popping up in his head. “Who is on the other side?” he often wondered. Over time, “the man who solved the market” concluded that Renaissance was exploiting the behavioural biases of other professional traders, both big and small. “The manager of a global hedge fund, who is guessing on a frequent basis the direction of the French bond market, maybe a more exploitable participant,” Simons had said. His partner, Henry Laufer, had a different take. He believed that it was a different set of traders known for their excessive trading and overconfidence. According to Laufer, “It’s a lot of dentists” or retail investors.

If retail investors are increasingly withdrawing from the cash segment, then the balance would tilt more in favour of Simons’ theory that on the other side of his winning bets when it comes to investing will be another fund manager.

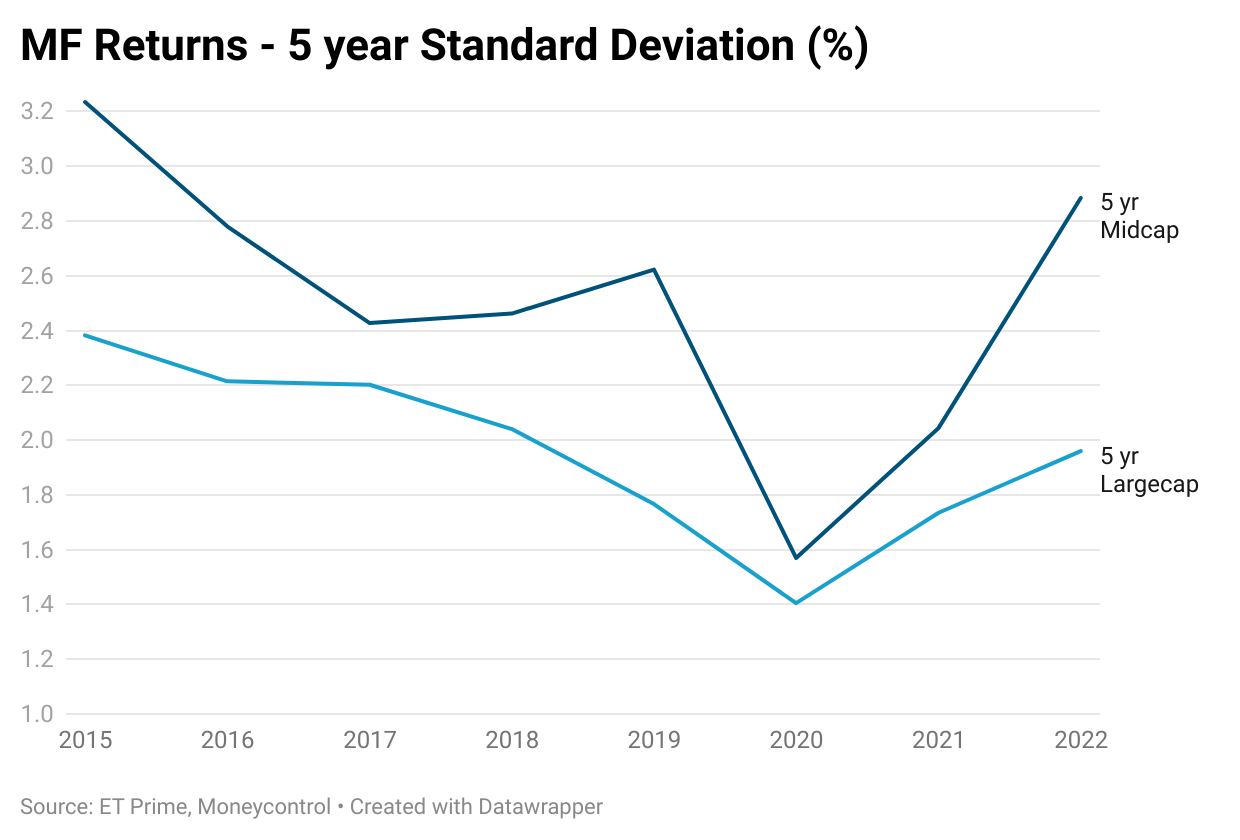

In the mutual fund industry today, the standard deviation of five and three-year returns have dropped dramatically. In simple terms, it means the gap in returns between the funds in a category has shrunk. The “paradox of skill” along with career risk causes MF managers to herd and become closet indexers.

The performance of funds is also prone to mean reversion. This means that while it is certain that some large, mid or small-cap fund managers will outperform peers, it is impossible to pick who that winner will be as top performers keep changing.

System and Process over Discretion

“I often talk about how the process is more important than the result… the result is just a by-product… But in today’s world, we are so focused on the by-product that we get away from the process. So, take care of the process, all the small things, and eventually you will get the desired result.”

M.S. Dhoni

When the “paradox of skill” kicks in, a systems-driven approach to investing and trading is more effective than a discretionary one to achieve a skill-based edge over the longer run. This is because when shorter-term outcomes become random or prone to luck, a repeatable process with an edge beats a discretionary process which is trying to solve for the last instance or trying to predict the uncertain future.

MSD picked this up many years ago and to his credit implemented it. “Take care of the process, all the small things, and eventually you will get the desired result,” said MSD. Many talked about it, but the man walked it. A victory or defeat in a single match never got him overjoyed or stand with his shoulders slumped. His body language and mental framework were largely unaffected by the outcome of a single match unless, of course, it was a world cup final.

Data doesn’t lie

In his book “Moneyball: The Art of Winning an Unfair Game”, Michael Lewis covers the aspect of analytical and process-driven statistical edge and instinct-based decision-making through the lens of Oakland Athletics baseball team’s general manager, Billy Beane. Later made into a movie titled Moneyball, it takes us through Beane’s (played by Brad Pitt) efforts to build a baseball team on a tight budget by relying on computer-driven data analysis to pick the best team based on each player’s strengths and weakness.

In an iconic scene in the movie, there is a committee of old-school scouts trying to pick players largely based on their own instincts and traditional methods of evaluating players.

In contrast, Beane, explains his new data-driven approach which is based purely on statistics and ignores extraneous factors such as the player’s walk, perceived confidence or popularity. Predictably, he faces huge resistance from the scouts. “You don’t put a team together for the computer, Billy. Baseball isn’t just numbers. It’s not science… They don’t have our experience and they don’t have our intuition… There are intangibles… You’re discounting what scouts have done 150 years,” they tell him. “Adapt or die,” Beane shoots back.

Of course, Beane is not suggesting that one should blindly let computers make all the decisions. All he is saying is that one should take data into account and see it how fits into the scheme of larger things — just like how various factors such as valuation, momentum, quality, and volatility are used to build a portfolio of top-ranked stocks. This approach contrasts with a discretionary fund manager’s process wherein s/he may pick stocks purely based on individual discretion and analysis.

Even discretionary investors and fund managers have a system and process though it may not be possible to codify them as opposed to a quantitative systematic approach. A quant-fund manager, too, may exercise discretion while executing if the situation demands, but this would be in the rarest of rare situations.

Surgeon and author Atul Gawande’s book, “The Checklist Manifesto: How to Get Things Right”, is a great read on how checks and balances help in eliminating errors. When humans are involved in a process, there can be small lapses which can prove fatal, especially when the steps become repetitive leading to heuristics or shortcut-driven decision-making processes. However, having a checklist helps in reducing missteps. It helps to:

- Identify blind spots

- Increase consistency

- Reduce bias

- Improve continuously

When the “paradox of skill” starts its work and discretionary analytical edge starts eroding in investing a behavioural- and process-driven approach will separate outperformers and underperformers. Hence, having a process or system to drive investment decisions and following that confidently even during tough times is what gives an investor the real edge.

Being Human: Man + Machine > Man/Machine

Jeff Bezos once asked Buffett, “Your investment thesis is so simple… you’re the second richest guy in the world, and it’s so simple. Why doesn’t everyone just copy you?” And the Oracle of Omaha replied, “Because nobody wants to get rich slow”.

Patience is key in the long-term game of investing and a solid set of data-driven systems and processes would go a long way. But how much of it should be left to the computer? Let’s try to answer that with a few counter-questions. Have aircraft pilots been replaced by machines? Do quant-fund managers hand over the entire investment process to computers? Do authors use their creativity while writing a book using chatGPT?

We all know the answers. Humans are the key to any logically driven decision-making process. However, a significant portion of the analysis and the execution part, albeit with enough oversight, is handed over to machines. Machines give human beings an edge to overcome many errors. Our brains are over 150,000 years old. But the markets are only 400 years old and we are using our hunter-gatherer-like brains in the stock market, which is designed for rational minds. We see danger when there is none and we panic when we should be calm to take advantage of the situation.

From Tulip mania to the South Sea Bubble to Great Depression to Black Monday (1987) to the Asian currency crisis to the dot-com bubble to the 2008 financial crisis and more recently the Covid-19 crash, each major event in the history of the stock market has proved one thing — the trigger event may vary but human behaviour doesn’t. Salman Khan would simply call it “Being human”.

Sticking to the strategy

Greek king Odysseus was probably the original forefather of systematic investors. Warned by goddess Circe that on the way back to Ithaca he would encounter the Sirens, or winged monster women who lure sailors with their melodious singing and cause shipwrecks, Odysseus devised a plan. He asked his crew to tie him to a post and ordered them to close their ears with beeswax. Irrespective of how much he begged and pleaded, under no condition were they to untie him. Cliff Asness, the co-founder of AQR, said in an 2019 interview, “A huge part of our job is building a great investment process that will make money over the long term, but a fair amount of our job is sticking to it like ‘grim death’ during the tougher times”. So, what do Odysseus and Asness have in common?

They both know they must tie themselves up to a post. However tempting and seductive the singing of the market’s Sirens becomes, fund managers like Asness won’t override their investment process. Because they know that to survive this journey, they should remain tied to the proverbial post.

Speaking to The Economist recently about the comeback of value investing, Asness shared his experience during the valuation bubble of 1999-2000 and added that 2018-20 was very similar. During that period, AQR analysed tech stocks and found similar results to that in 1999-2000. The conclusion was that the investment world seemed to be a bit crazy and hence the most sensible thing to do was to stick with the strategy.

The bottom line

When asked whether he ever thought of throwing in the towel, Asness admitted that at times he faced a ‘crisis of confidence’ in the middle of the night and doubted whether he has been plain lucky over the last 25 years or whether the encouraging results in the past were because of data-mining, analysis, and a systematic approach to investing.

Asness thinks it’s normal to have such self-doubts once in a while and that anyone who doesn’t have them is either dishonest or crazy. However, he says if one understands one’s own investment style may underperform during tough times while long-term evidence shows its performance is strong, it should give enough confidence to stick to a strategy like “grim death”.

But that’s not easy. That’s why a data-driven edge — even when there are unknowns — is not a fleeting phenomenon but rather a long-term edge. We believe, our quantitative data-driven process which is essentially based on fundamental investment principles applied systematically, is our edge.

Global Backdrop

The trend of de-globalization of supply chains which started in the aftermath of the covid pandemic and later strengthened by the Russia-Ukraine war continues. This will lead to companies building slack in their global supply chain to account for any major disruptions. Companies are moving production to countries with aligned political stands to make supply chains stronger in case of geo-political tensions. An IMF study believes that countries such as India and Indonesia and regions of Latin America, which remain relatively non-aligned may stand to benefit from this. This is already evident from the way India has been able to source oil from Russia and at the same time get companies like Apple and Foxconn to set up production units in India. We had a mini-banking crisis in the US, which was quickly resolved. Whether this was the canary in the coal mine and there are a few more similar accidents waiting to happen or we move on happily on from here is anybody’s guess. The Fed may pause here or go head with a few more dovish hikes. However, unless inflation slows down dramatically or there is a major accident like SVB, there seems to be no stopping the Fed from hiking rates.

March 23 bought some relief after two down months in January 23 and February 23. The current chatter is all about GPT and how it is an iPhone moment that changed and gave birth to many new innovative methods of using technology in our daily lives and work. Initial results look promising, and we are also working on how to use these technologies in our workflow.

Performance

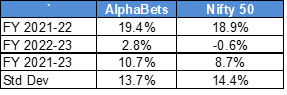

While the numbers do not reflect it, the markets were anything but dull in the last 12 months. Following our processes, we have managed to grind out a positive return (post fees), in contrast to the benchmark being down a shade. We hope the next financial year brings us better returns.

Stay safe and take care. Thank you for investing with us.

Anish Teli and QED Capital Team, April 2023