“When we control a company we get to allocate capital, whereas we are likely to have little or nothing to say about this process with marketable holdings. This point can be important because the heads of many companies are not skilled in capital allocation.”

—Warren Buett

American Epress, RJR Nabisco, and ITC – what connects the three? They are guilty of what Buett has called a management sin in his annual letters.

American Express CEO James Robinson had presided over a 10-year period when prots grew at 18% per annum, but shareholders never saw that return. Reason: he prots grew at 18% per annum, but shareholders never saw that return. Reason: he used the prots of a good business to buy many bad ones – in insurance, banking, broking, and an art gallery specialising in 19th century American paintings. All this didn’t paint a pretty picture for the stock. Good PR and a captive board kept Robinson in his job longer than he should have been. But the stock lost out, and investments did not yield returns. We will touch upon the other example in a bit.

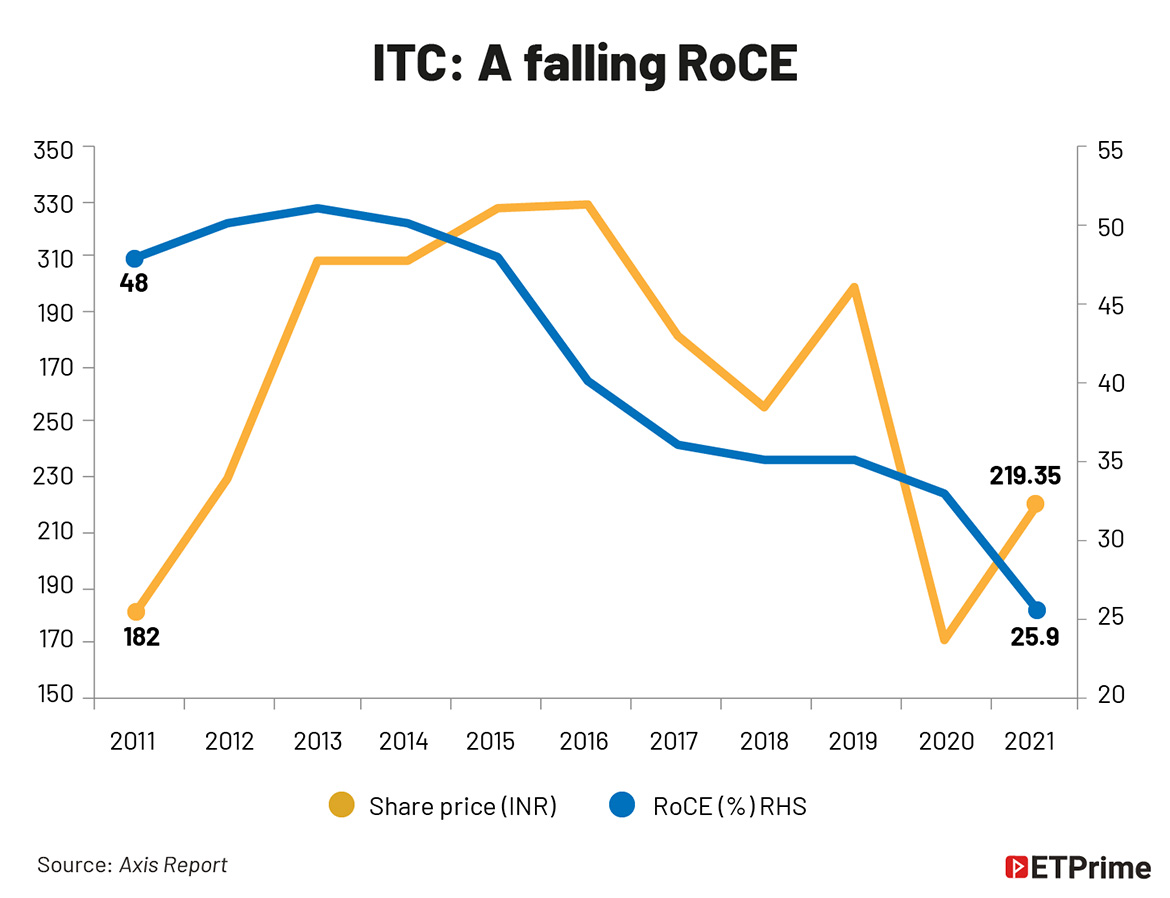

In 2009, Harsha Upadhyaya, the fund manager at UTI Opportunities, took a huge bet on ITC. It was a time when the world went into a global nancial crisis. The investment thesis was simple – no matter how the economy is moving, people will smoke. This was especially true for an urbanising country like India, where young people were becoming a globalised workforce. ITC was investing in FMCG, but its core was cigarettes, yielding a high return on equity (RoE). Between 2009 and 2013, ITC’s RoE moved from 25% to 35%.

From 2009 to 2014, ITC went up 30% annually against the Nifty’s 16%. It also became the largest stock in terms of market capitalisation and Upadhyaya became

a star fund manager.

ITC has never had such a big run in the stock market since then as the government kept on taxing tobacco, and the company, in its desperation, kept on investing in businesses that are yet to give big returns. Tax increases happened seven times during the past 10 years (2010-2019) as compared to six in the prior decade (2000- 09). As investors do not like highly regulated or taxed companies, over the years, they have started giving up on the stock.

Since 2014, the ITC stock has given annual returns of 0.77%, compared with 12.40% by the Nifty 50. The RoE of the business is falling – for FY20 it was at 23%.

But things are changing now.

Renewed investor interest

ITC has invested around INR88,100 crore in the non-cigarette business since 2002 and many investors feel that the worst is over for the company.

Now, there is a slew of investors who are buying the stock because they feel it has a lot of value, and if one is ready to wait for 10 more years, then ITC will be the biggest FMCG company in the Indian market. They are ne with the current underperformance. PPFAS, a well-known mutual fund and a value investor, has hiked its stake in ITC from 4.9% to 8% over the last one year and is now its largest holding among Indian stocks and second-largest position in its Flexi Cap Fund.

There are retail investors who are doing SIPs on the stock, and then there are HNIs who have invested lump sum. A PMS fund manager gave a presentation at the CFA institute and said that ITC is going to be the biggest FMCG stock in the next 10 years.

To the credit of all these investors, ITC has become the No.1 player in atta, No.3 in biscuits and No.2 in potato snacks. It is also No.2 in shower gel and body wash. b scu ts a d o. potato s ac s. t s a so o. s owe ge a d body was . A Morgan Stanley report states that ITC expects to grow the FMCG business to INR1 lakh crore by FY30, a growth of 23% over the next 10 years. “If ITC delivers on the margins, any further investment in the FMCG business may not be an investor concern,” the report argues.

So if there is so much clarity in the growth trajectory of the stock, then why is it underperforming the index? In any other new-economy company, where investors see linear growth in the future, the stock moves up. In the case of ITC, all this optimism is not captured.

Is the market pricing the stock correctly? Has the company got its capital allocation right?

An optimum capital allocation

Now let’s come back to RJR Nabisco. It is one of the well-known and largest LBO (leveraged buyout), circa 1998, which put KKR on the map. A compulsive actionaddict Ross Johnson ran out of targets and at the same time felt that the market was not giving his company its due valuation. He put the company into play and tried to take it private but was thwarted in his attempts by a wily banker Henry Kravis. RJR Nabisco was ultimately broken up. The tobacco business ended up with Philip Morris and the foods business with various companies like Kraft Heinz and Mondelez, and some to other PE funds. A 20% stake in ESPN was also among the mix. This event made for an excellent bestseller titled Barbarians at the Gate which went on to become a movie produced by HBO.

It is highly unlikely that we will see that with ITC. It’s compressing price multiple has entered the radar of many savvy ‘value’ investors who like Johnson feel the company is under-valued by the market and over-taxed by the government. ITC is traded at a P/E of 20x (based on the last twelve-month EPS) which is higher when compared with 15x over the last one year. Value investors feel there has never been a better time to buy this stock. The company is now on the right path of generating non-tobacco prots.

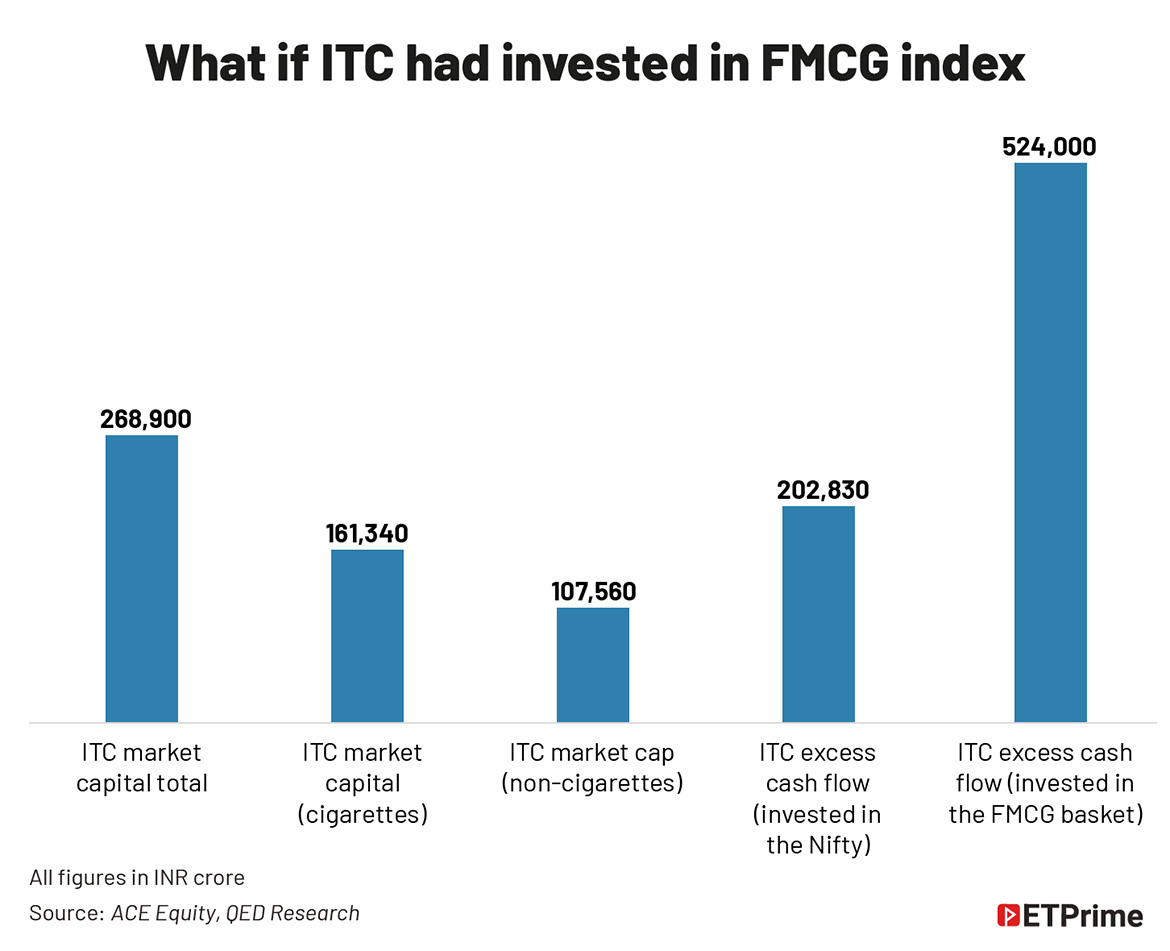

We did a simple thought experiment. If ITC was a conglomerate like Berkshire Hathaway, how would it think about capital allocation. Since we have the benet of hindsight. Let us assume that the other options were:

- Invest in a basket of FMCG companies

- Invest in Nifty 50 Index Fund

The table shows that if the excess cash ow was invested in the Nifty broad-based index, it would be double of what the market attributes to ITC’s non-cigarette businesses. And if it had invested in a basket of FMCG business (which also has ITC), it would have been 5x of its FMCG business. Instead, the INR81,300 crore, invested by ITC, has grown to an anaemic INR1,07,560 crore.

hat wealth creation in FMCG looks like

ITC has given a price return of 12.3% CAGR (INR20 to INR213 now) from 2001-2021. Nestle on the other hand has delivered 20.3% CAGR. Standalone tobacco

companies like Altria has delivered 16%, while British American Tobacco (BAT) has returned 10% in the same period. Dividend yields by tobacco companies are in the same range.

Clearly this shows that ITC has some way to go from here. And on priority it will also have to lower its dependence on cigarettes. Last week Joe Biden declared a

war on tobacco. The idea is to reduce the nicotine content in cigarettes to make them less addictive. New Zealand has similar plans. Stocks of Altria went down by

6% and BAT and Philip Morris also traded below 1%. Similarly, ITC was down 1.5% in the Indian market over the last ve days.

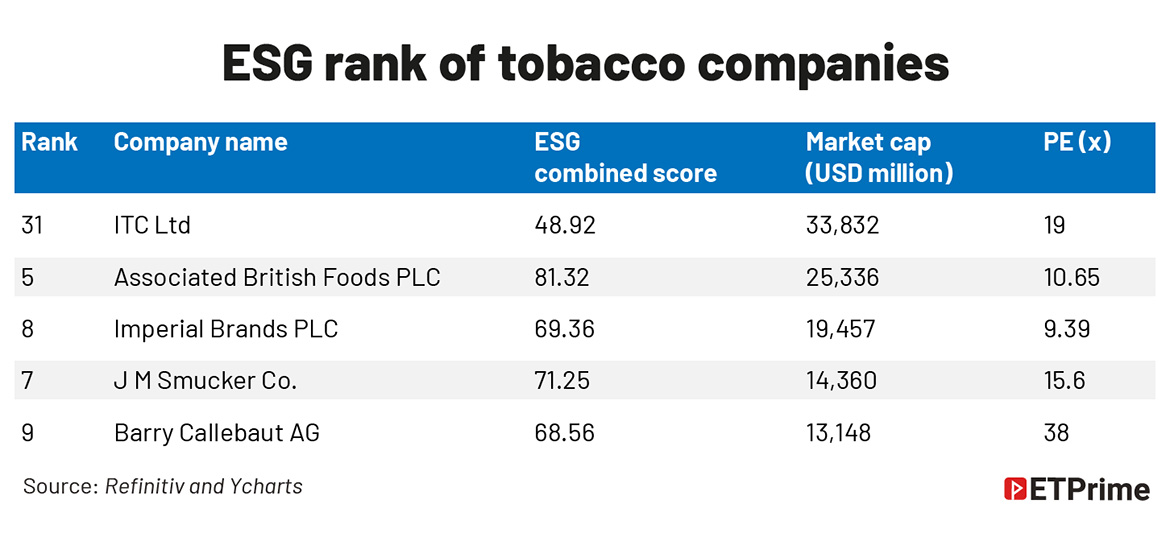

Politicians across the world want to either tax tobacco companies or simply reduce the impact of tobacco on citizens. The other big issue is the ESG factor.

AUM of global ESG (environmental, social and corporate governance) funds is now USD1.6 trillion and over 1,700 of them have a no-tobacco investment policy

compared to a handful of such funds less than four years ago. This is one of the major reasons for ITC’s valuation multiple’s contracting signicantly to its

historical valuations. ITC accounts for 11% of the total market capitalisation for cigarette companies across the world at USD3,382 million. It is the top company in terms of market cap but at the same time it is ranked 31 on the ESG score at 48.92.

The second company, Associated British Foods, has an ESG score of 81 and is ranked fth on the ESG score with a market cap of USD25,336 million.

Clearly, ITC has a long way to go when it comes to ESG score. FIIs are taking ESG scores seriously.

Earlier, FIIs did not mind investing in a company as long as it is focused on EPS. This is in line with Buett’s way of thinking. When he bought junk bonds of RJR

Nabisco post the LBO, he received a letter from Ben Graham’s son, protesting Nabisco post the LBO, he received a letter from Ben Grahams son, protesting

against this investment in a tobacco company. And the sage, who has implored us to think of ourselves as partners in a business even if we buy a single security in a company, replied that while he would not manufacture tobacco products himself, he would have no problem owning traded tobacco companies or newspapers that advertise tobacco products. With some verbal yoga akin to the one practised by active mutual-fund managers, he concluded that while perhaps it wasn’t strictly logical, but in a complex world, one had to draw the line somewhere. It could not be black or white.

FIIs, however are not in agreement with Buett’s reasoning and have been reducing their holdings in ITC – in the last four years it has fallen from 20% to 13%. Even the number of FPI holders has dropped by 20%.

Mutual funds and retail investors on the other hand have embraced the stock with their holdings going up by 20%, compared to their holdings over the last four years.

Creating shareholder value

The Morgan Stanley report on ITC called The Smoke is Clearing makes some interesting points about what went wrong with the company over the last decade.

Here is what the report says:

ITC only achieved Ebitda break-even in FY13 – 11 years after its FMCG foray began and even today the Ebitda margins are lower than FMCG peers. It’s Ebitda margins are at 7%, against 23% for Nestle and 25% for HUL based on FY20 data.

There are multiple reasons for this. The report says that 30% of revenue is from the commoditised atta segment (the Aashirvaad brand) where margins are just midsingle digit. The company made rapid expansion across multiple product categories and investments in product development, brand-building, infrastructure development, and a lower contribution from higher gross margin

personal-care categories (personal care accounts for 10% of FMCG revenue).

Since FY03, ITC has invested INR7,800 crore in FMCG, INR7,100 crore in hotels,

and INR1,600 crore in agri. However, these businesses continue to make negative free cash ows (dened as Ebitda minus non-cash expenses minus tax minus capex). Since FY03, the cigarette business has generated cumulative free cash ows of INR88,800 crore, while the FMCG, hotel, and agri businesses had cumulative negative free cash ows of INR81,300 crore.

Second is the taxation aspect. The report says that cigarette taxes have been raised in 75% of instances in the past 29 years. Sharp tax increases became frequent (six successive years of over 10% tax increases) in 2010-19 and thus it hurts volume and Ebit growth as compared 2000-09, when there were no two consecutive years with 10% tax increases; the 14% tax increase CAGR in 2010-19 was double the 7% level in 2000-09. This resulted in average cigarette prices doubling, much faster than the income growth, and consequently cumulative cigarette volumes were down 21% in FY13-FY18 During such periods when cigarette aordability is impacted pricing FY13 FY18. During such periods, when cigarette aordability is impacted, pricing can no longer make up for volume declines. Consequently, the cigarette business’s Ebit growth over the last ve years has been much weaker at a 6% CAGR, compared with 13% and 12% CAGR over the last 15 and 10 years, respectively.

If ITC is indeed serious about creating shareholder value, it would do well to split the tobacco and non-tobacco businesses. The non-tobacco businesses, especially (FMCG, agri, and hotels), will need cash-ow support and some sort of structure can be devised here to ensure that the lifeline is kept on for a while. Splitting the business, however, will help investors make a choice of owning the tobacco and non-tobacco business as well as assign a fair market-determined valuation to the separate businesses and align incentives for the management teams.

The possible triggers

So, while there are value guys who probably have a right stand on the stock, the fact is that ITC as of now lacks a trigger for valuations to mean revert. This trigger could come from a couple of factors.

1. Valuation multiple of value stocks reverting to mean: Value stocks (stocks available at a relatively low price multiple) have massively underperformed growth stocks and other factors like broad market, momentum, size etc., over the last decade. Year 2020 has been the worst for value stocks. The second worst year (1999) was followed by a very strong comeback of value comprising what were called the old-economy or brick-and-mortar stocks post the dot-com bust. Since November 2020, value has made a comeback and is having its second-best quarter ever.

2. Split up the businesses: ITC could come up with a creative way to split up the businesses or at least indicate a timeline here. Morgan Stanley in its report says, “We believe splitting up the business would likely enhance the valuations of nontobacco businesses given the negative ESG impact from the cigarette business.”

3. Signicant turnaround in the FMCG business in the next ve years with a benign tobacco tax environment.

4. A low probability event could be if the government chooses to divest its stake in ITC, leaving one clear owner. Here is an interesting example about triggers. The now infamous Neil Woodford, who managed the Invesco Perpetual Income and Invesco Perpetual High-Income funds with a combined AUM of over GBP20 billion, made a fortune in the 90’s in tobacco stocks.

There was a view that some of the world’s largest tobacco manufacturers were at signicant risk of litigation from individuals and local authorities who wanted to sue them to cover the cost of healthcare resulting from years of smoking. But the research note from Hodges claimed insurance policies taken out by tobacco giants, such as BAT, would prevent them from having to dip into the company coers to pay out in the event of successful court claims. Tobacco stocks, Hodges concluded, were therefore vastly undervalued. The research was enough to convince Woodford and so began his long term investments in some of world’s biggest Woodford, and so began his long-term investments in some of worlds biggest cigarette manufacturers. “Hodges persuaded Woodford to buy tobacco stocks when they were on their arse. He did that and he made a fortune” – From When The Fund Stops: the untold story behind the downfall of Neil Woodford, Britain’s most successful fund manager, by Divid Ricketts

A value bet or a value trap?

Indian investors feel ITC is literally now a smoking value buy available at a very cheap valuation. But then there are others who do not agree. To see this, we don’t have to go far. Indian FinTweet gives all the pros and cons of buying ITC as a longterm stock.

FinTweet is divided down the middle on whether it is a value stock or a value trap. Leading the pack is D Muthukrishnan who tweets under the handle called @dmuthuk. He feels that ITC is one of the best stocks for long-term investing. He has got into arguments with Twitter celebrity investors related to ITC. On March 28, he had tweeted, “I invested in the businesses of ITC and sharing my thoughts on the same. My critics are focusing on price movements of ITC and mocking me on the same. Business performance and price would denitely converge. It’s beyond my ability to predict when. So, continue your criticism.”

While he has a long-term view, there are other marquee investors who have their doubts about the stock. Shankar Sharma is one of them. “In all my life, I haven’t heard a bigger hype for a stock, than ITC. Ek saal sey sun sun ke pak gaye and kuch anti bolo, to trolling. Bhugto,” he tweeted on March 3, 2021.

The long-term value investor might just get this right as the management is getting active about its capital allocation. Whether ITC will prove to be a protable endeavour or a value trap, only the time will tell. But as of now odds are on the latter. More importantly, the market has valued the stock fairly. If things work in the favour of value investors, this stock might simply have a good upside. They should be aware that more often large-cap stocks price in information faster than they can update their beliefs.

(Anish Teli is the managing partner and principal oicer at QED Capital Advisors. This article is for information purposes only and not a recommendation to buy, hold or sell.)

(Graphics by Sadhana Saxena)