Financial markets, like floods, hurricanes, and other irregular and random phenomena in nature, are inherently unpredictable. They are not “mildly random,”…“but wildly random.”

— Benoit B. Mandelbrot in New Methods in Statistical Economics

Markets are at an all-time high and IPOs (initial public offerings) and NFOs (new fund offerings) are hitting the bourses every other day. Even on a one-year basis, the Nifty is up by 30%. Some experts feel we are in the last leg of a bull market and from here the returns will be subdued. However, there are others who expect the stock market to continue its run. But what if the equity markets fall from here? There are many questions an investor faces in this scenario. Should the portfolio be rebalanced? Is it time to book profits and sit on cash? Or should one view this as a “once in a lifetime” opportunity and call the foreign relative to go “all in” crypto.

Right asset allocation is the answer.

Creating the investment basket

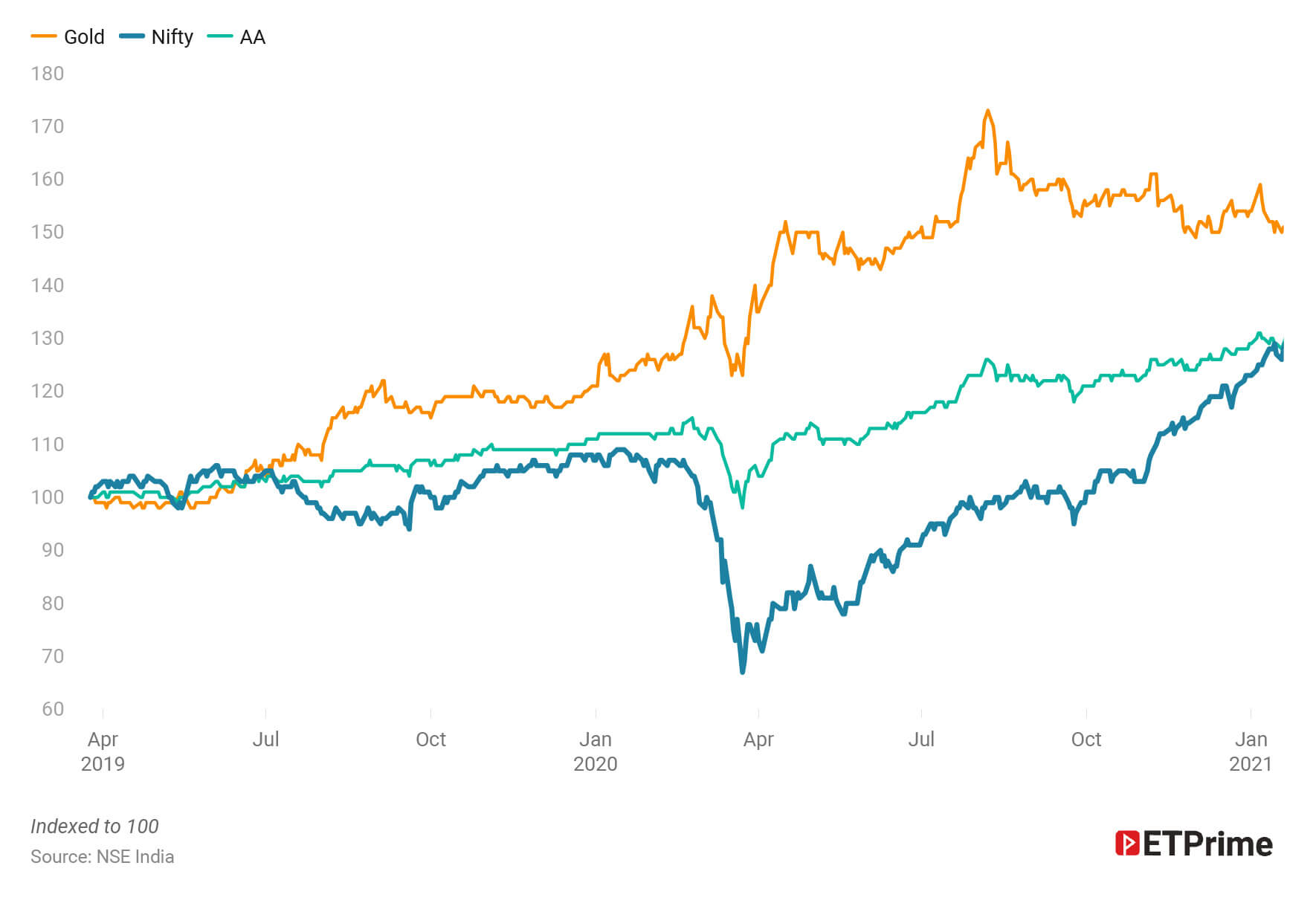

The stock market crashed 40% in March 2020 from its peak that year. If you had invested INR300 in the beginning of 2019 in the Nifty 50, your investment would have been down 27% at INR219. But had you invested INR100 each in Nifty 50, Gold ETF, and liquid funds for the same period, the same amount would have grown to INR307. This is because when the equity markets went down 27%, gold was up 34%. It acted as a hedge. Your money in the liquid fund almost remained the same.

Similarly, had you invested this INR300 in the Nifty 50 for two years, till date you would have made INR411. But in case you had distributed the same among the three assets then you would have made INR363. Here, we took a basic assetallocation example to give you an idea of how it works in times of volatility. It is important to remember when the market crashed in March 2020, anybody who had planned his/her asset allocation was in the money.

2019-21: A smoother asset-allocation journey

Let’s use a different example. Have you ever seen a child (or adult) play with the same kind of Lego blocks? It’s not much fun. It is only when various colours, shapes, and sizes are added to the mix that things get interesting. Patented in 1958, Lego has retained its basics ever since. Its simple, child-friendly design has been credited with its longevity and popularity across generations.

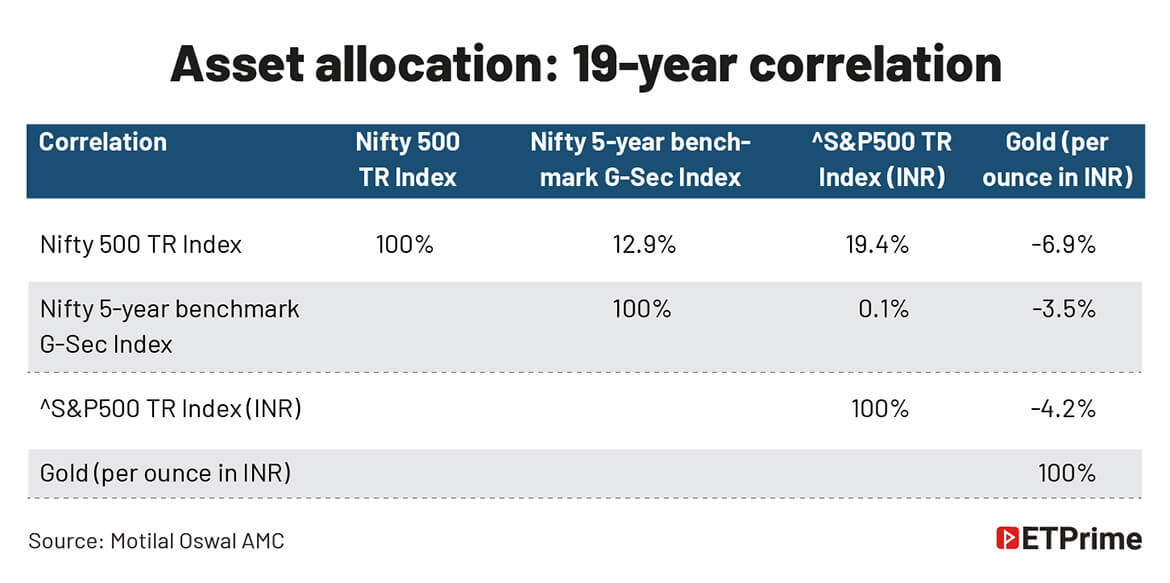

Till recently, it was akin to building blocks for asset allocation in India. We had the Nifty 50 and the Nifty Next 50 along with gold and debt funds — similar to selflocking Lego bricks in their simplicity, robustness, and basic design. But in the last few years, many interesting building blocks like index-based factor funds in equity and fixed-maturity bond ETFs (exchange-traded funds) have been launched. Along with that, we also have international index funds based on S&P500 and Nasdaq 100 which have become popular among early adopters. We also have pre-packaged multi asset-allocation funds like Ray Dalio’s All Weather Portfolio and Harry Browne’s Permanent Portfolio, being launched. All this has made asset allocation an interesting and important function for a financial advisor. She can finally move beyond Indian equities and gold. Low-cost customised asset-allocation portfolios can now be designed for clients as per their goals.

So, what is the basic framework that one can use to put together a customised asset-allocation design?

The framework

According to Ben Graham, asset allocation is the first decision one must make when it comes to investing. Graham also talks about asset allocation in his 1949 classic, The Intelligent Investor:

“We have suggested as a fundamental guiding rule that the investor should never

have less than 25% or more than 75% of his funds in common stocks, with a

consequent inverse range of between 75% and 25% in bonds. There is an

implication here that the standard division should be an equal one, or 50-50,

between the two major investment mediums.”

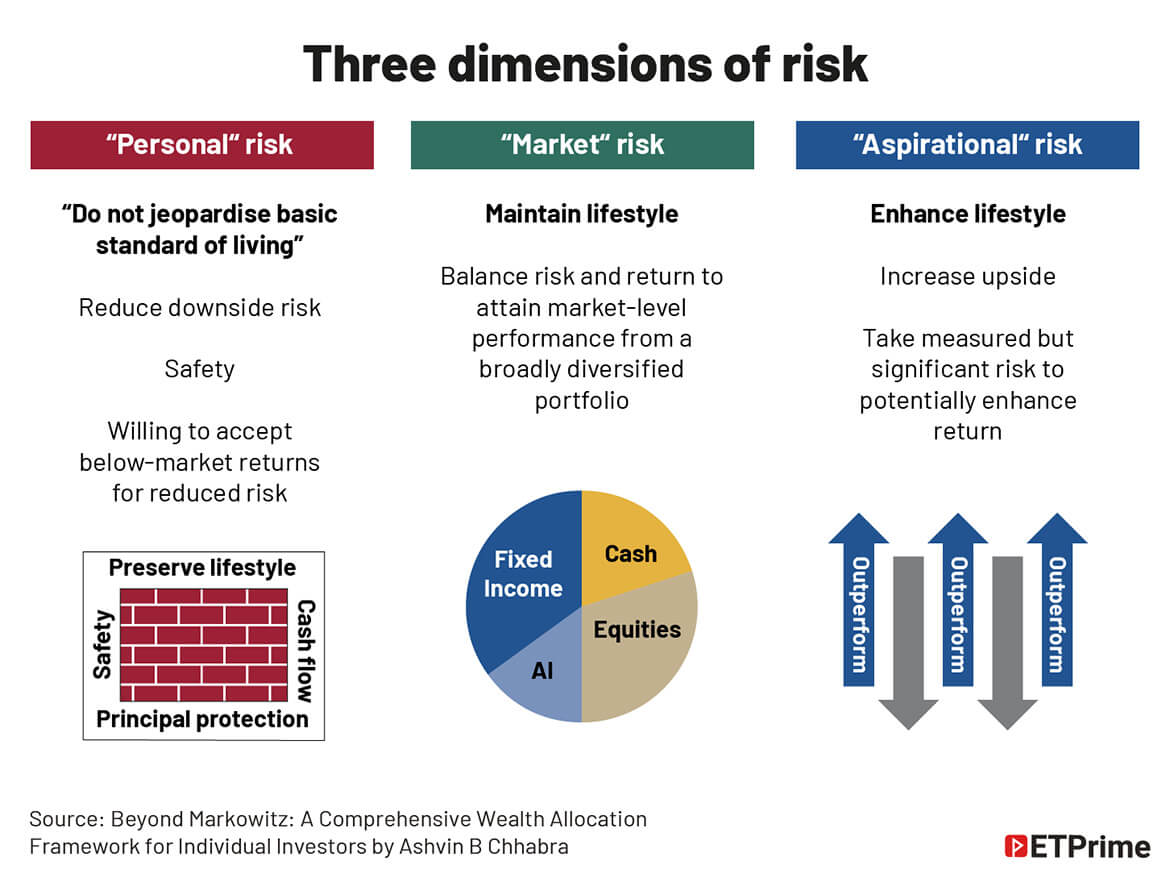

Ashvin B Chhabra, head of Jim Simons’ family office and the father of goal-based investing, wrote a seminal paper on the overall asset-allocation framework and how to view other assets like home, primary business, seed investment in startups, etc. Chhabra calls this the “Wealth Allocation Framework” which is underpinned by risk allocation or allocating an asset in three different risk buckets based on personal risk assessment.

This exercise should preclude the selection of assets and fund managers. The big takeaway here is that there is no free lunch — assets that provide safety from market fall will not have high-return potential and vice-versa. The three risk buckets are:

- Personal risk: Will have assets that limit the loss of wealth but will probably yield below-market returns. For example, cash, annuities, insurance, primary home, and human capital.

- Market risk: Will include assets that provide risk-adjusted market returns in line with modern portfolio theory. Mostly all conventional equity investments will fall under this category. Fixed-income investments that carry interest rate and credit risk also belong here.

- Aspirational risk: Will have assets that yield above-market returns but carry a much higher risk of capital loss. Example, venture capital, early-stage “angel investments”, family-owned businesses (if they form a significant portion of the net worth). In addition to this, ESOPs, hedge funds, leveraged real estate would also fall under this risk bucket.

Points to remember for successful asset allocation

1. Quōvādis? If you don’t know where you are going, any road will get you there. So, the first question one must answer is: what are the goals one is saving and investing for? From there flows most of the solutions. An investor’s life stage, amount of capital, and Maslow’s hierarchy of needs help one prioritise among these goals and allocate finite capital efficiently. Goals can be classified into:

- Safety – These are goals that help you preserve your lifestyle in case of any unfortunate incident or episode. It could also be the minimum amount of net worth that one would be comfortable with in a worst-case scenario.

- Comfort – This enables to maintain one’s current lifestyle and goals in a basecase scenario. Here, one takes more risk than in the previous bucket and balances it out with the return one expects.

- Opportunities– Here, one is willing to take the capital risk. These investments, if they pay off, would put you in the next orbit. In case they don’t, they do not affect your current life goals in any way.

2. Low cost and expenses: Cost of investing includes sales commissions, advisory fees, fund-management expenses, brokerage commissions, and early tax realisations which can vary by several percentage points annually for investors. Over an investor’s life cycle, this can eat into wealth accumulated by over 50%. For most individual investors, cost often is the most important determinant of portfolio performance over asset allocation, market timing, or stock/fund selection. And here, a low-cost broad-based index fund is usually the best choice for equity exposure.

3. Asset allocation: A famous study titled “Determinants of Portfolio Performance” puts the impact of asset allocation on portfolio performance at over 90%. If you fell

for it, don’t worry, you are in august company. Even Jack Bogle did. It was later clarified by William Jahnke that the study was talking about “variation of quarterly returns” and not the long-term performance. This study has led to many fund houses launching fixed-allocation funds based on historical returns. Jahnke clarifies that asset allocation is important but not 90% responsible for returns. Bogle clarifies in Common Sense on Mutual Funds that, initially, he also misunderstood the study. Further, he goes on to say that there is no formula for deciding one’s asset allocation, and he in his retired life went with a 50:50 allocation to equity and bonds. It all depends on your goals, risk ability, and tolerance.

4. Rebalance to adjust risk weights: Watch closely, but not frequently. Asset allocation should be dynamic and consider an investor’s current situation and future expected returns. Hence, should be reviewed at periodic intervals. You are investing to meet your financial goals, but if you keep checking too frequently your eyes will not be on the road ahead. Most successful batsmen say they don’t watch the scoreboard too often. They plan for the over ahead and take it session by session. They focus on the present with the idea to take the game to the end. Similarly, take your investment goals year by year and adjust for life events, good or bad as they come. If you obsess about every single day or decision, you will miss the big picture. In times of stress, all correlations go to one.

5. Risk lies in the eyes ofthe beholder: The dictionary definition of risk is “the possibility of suffering harm or loss”. During your lifetime, you will see many ups

and downs. In financial markets, the risk is literally the loss of capital. However, the “measure of risk” depends on your time horizon. Assume that you start saving for your child’s college education a few years after his or her birth. At that point, your investment time horizon is long. Years pass, and once your child is a year or so away from college, a market decline like in 2008 or 2020 can throw a spanner in the works. You need to de-risk your investment. Everyone will be both long-term and short-term investors at some point in life. As Michael Mauboussin puts it,

“markets aren’t efficient if one group dominates.”

6. Benchmark rightto ensure you are on track: The aim is to reach your financial goals and not to beat the market every year. It is easy to benchmark against the

market because data is easily available. And it is also possible to get shaken when the market crashes. However, if your goal is 10-15 years away, these yearly falls are

something that you will encounter along the way. The correct benchmark is your own personal investment goal — if you are on track to pay off your home loan, to

save for retirement, or send your child to college. Also, it is okay to accept a slightly lower rate of return in exchange for downside protection in the short run.

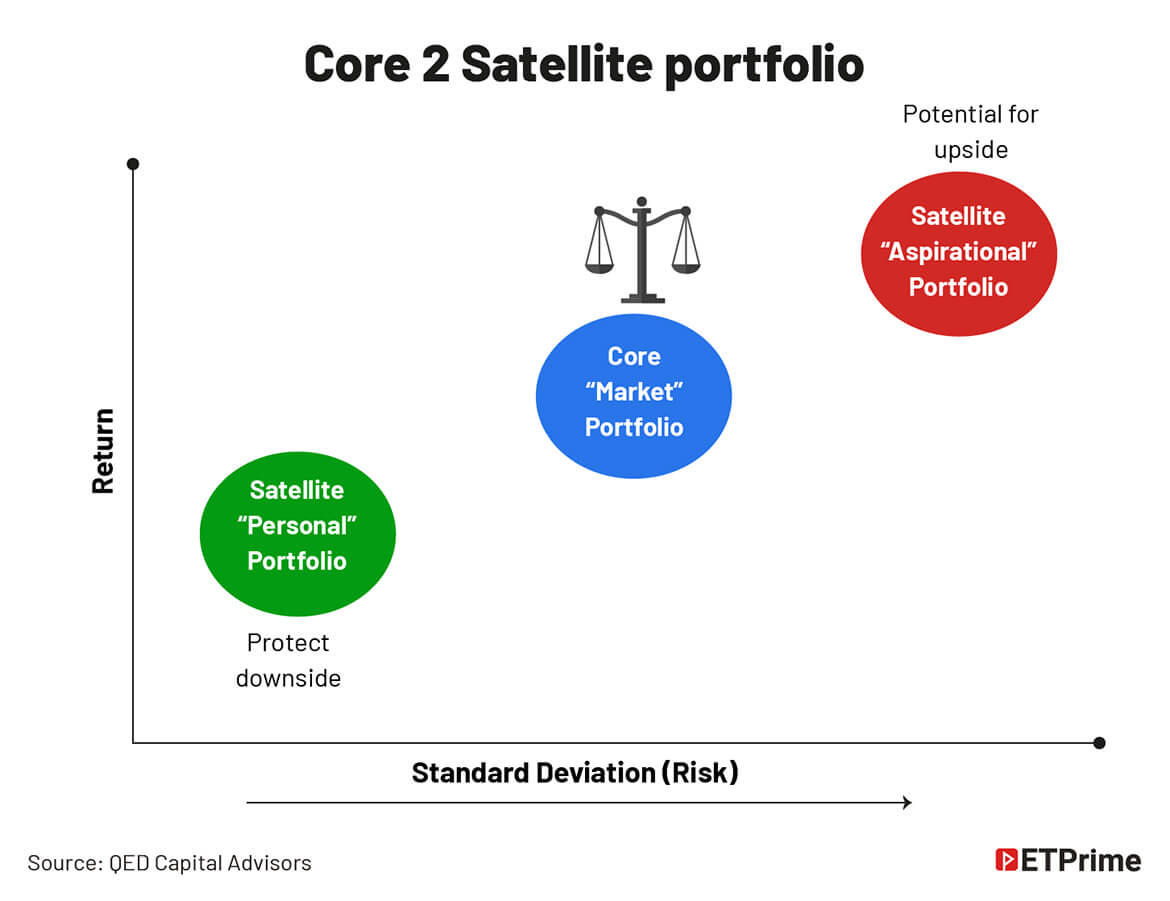

7. Putting it alltogether: Finally, one can use the framework above to make a core portfolio which targets goals that help maintain one’s current lifestyle in the base

case. These can be complemented with two satellites — one that protects the downside in case of the worst-case scenario and the other with higher risk and pay-off that may enable the investor to shift to a higher orbit but with no harm to the current lifestyle

Don’t miss the ‘personal’ in personal finance

Everyone’s life circumstances, risk ability, risk tolerance, and experiences are different. This is why sometimes we miss the “personal” in personal finance. Let us

take the example of P Kumar, a 28-year-old married techie working at a large Indian software firm in Bengaluru. His current CTC is INR20 lakh, which he expects will grow at the rate of inflation over the next 30 years. He also is entitled to ESOPs in his company, which is listed on the NSE. He is looking to build a retirement corpus that he will need when he reaches 55-60 years. Kumar will, perhaps, face his first hurdle when he reaches the age of 35- 40 years. Either he would have moved up the ranks and become a team leader or he would have

chosen to become a domain expert. In either case, this is an age where many tech firms cull out high-cost employees when times are bad. Now, how would one broadly use the wealth-allocation framework we introduced above to help Kumar?

1. Personal risk: EPF, PPF, ancestral home, insurance, and human capital

2. Market risk: Retirement fund invested in 60:30 ratio in an index equity fund and debt funds as a “core” investment. This is rebalanced after review on an annual basis. A “satellite” allocation of 10% is made to two international index funds.

3. Aspirational risk: ESOPs allotted will vest over five years. When cashed and reinvested, it can be reallocated in the risk buckets above. We have deliberately

not gone into too many details about the numbers as we wanted to focus on the qualitative aspects of planning.

The same plan may be different for a practicing chartered accountant or lawyer. For a medical doctor, again, it may be different as most start earning relatively later

than other professions. Similarly, it may be different for those in the media and show business. They have relatively lumpy income streams and therefore a

different plan needs to be put in place for them.

Most asset classes can be used on the Lego “system of play” principle that all blocks should interlock and be interrelated— and increase both the imaginative

potential of kids and sales — the system became the foundation of modern-day Lego. Asset classes are by nature interrelated and are the financial market’s Lego

bricks. It is now up to the advisor and investor to use these building blocks to create a robust portfolio.

(The author is the managing partner and principal officer at QED Capital Advisors.)

(Graphics by Sadhana Saxena)

(Originally published on Mar 31, 2021,12:00 AM IST)