Investments Strategies

Aligned to Your Financial Goals

Markets are dynamic & volatile. The direction of markets can change frequently.

With our knowledge & expertise, we use a quan titative driven, process-oriented approach to ensure that your investments are aligned to meet your investment goals.

Our core philosophy follows the four key principles.

Overcoming Behaviour Gap

The behaviour gap refers to the cognitive errors that can adversely affect investment decisions.Herding

Mimicking the actions of a larger group

Anchoring Bias

Relying heavily on the first piece of information received

Confirmation Bias

Ignoring information contradictory to prior beliefs

Disposition Effect

Selling winners to early & holding losers for really long, in the expectation of ‘comeback’

These gaps cause pricing inefficiencies and irrational behaviour. This leads to a gap between what investors can achieve vs what they actually achieve.

Let’s take a look at the time Sensex has spent in different PE bands (closing basis)

Mr. Market offers us opportunities at Cheap, Fair & Exorbitant prices.

![]()

2% net flows in equity mutual funds in the cheap markets.

Do we really buy low and sell high?

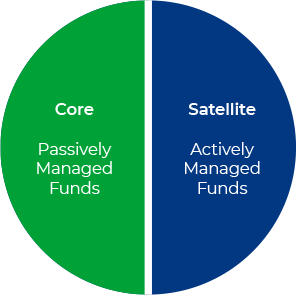

Our investment strategies offer a combination of a core & satellite portfolio for investors to create long term wealth by diversification, appropriate asset allocation & consistent monitoring.

Our investment strategies offer a blend of actively & passively managed portfolios, balancing growth and security.

Investment Strategies