Stay the course

CY 2024 was a year of two halves. The market perhaps peaked out in June – Sep when the current dispensation came back to power, India won the T20 world cup and markets bounced back post-election results. When the market is in an uptrend, no position feels large enough, and there is regret of missing out. When the market is in a downtrend, no position feels small enough, and again, there is regret of losing. When the market is in a sideways move and no money is made or lost, opportunity cost is lost, and again, there is regret. Investors who can minimise their regret and stay the course are the ones who can reap returns across cycles.

Nothing grows to the sky. Especially in stock markets. If there is one skill that is underrated in markets it is when to sell or exit. Similarly, the dilemma for a player past their prime is when to call it a day. Gavaskar’s guideline is to retire when people are still asking “why” rather than “why not”. A similar approach can be applied to stocks. Some investors can sell their stocks into strength and some wait for the strength to weaken and sell into weakness.

After winning the T20 World cap on June 24, the performance of the market this quarter was much like the Indian Cricket Team down under. The young guns fired consistently and the strong mid-caps kept you in the game. But the large caps were clear underperformers. And those that had done exceptionally well in the past since covid, are now in the process of perhaps peaking out or consolidating. For this phase, one can explain the fall due to FII selling. However, in the end, it is all about earnings.

The 3-0 loss to New Zealand at home, was an aberration says the captain. So the fall of almost 7-10% (depending on which index one is looking at) was also just cooling off in the market. But when it is followed by two losses and two almost losses in Australia, it’s a pattern as are the falls in November and December. The Small and Midcaps though in sync with Jaiswal and Nitish Kumar Reddy continue to deliver. Until December. In January the SMIDs have given in with even more volatility. I hope Jaiswal and NKR don’t follow in their footsteps. With a mega-cap like Bumrah injured, another old warhorse, Shami will step in to take his place. But the laggards are Ro-Ko.

Coming back to markets, what can we say about the Large Caps then? Is it time to get rid of them or should we give them another chance? Our rules-based process does not play favourites. It is ruthless in cutting out underperformers and moving to cash/gold as the case may be. Stocks that don’t perform well are removed when the portfolio is rebalanced. For our cricket team however, if the individual chooses to continue after repeated losses then the selection committee (or the index management committee) has to step in and bid adieu.

Investors and Downturns

Fundamental discretionary investors have their stories and narratives which help them sleep at night. Quants have their numbers and backtests. Cliff Asness puts it best when he says “Well the single biggest difference between the real world and academia is time dilation. Your sense of time does change when you are running real money. Suppose you look at a cumulative return of a strategy with a Sharpe ratio of 0.7 and see three years with poor performance. It does not phase you one drop. You go: “Oh, look, that happened in 1973, but it came back by 1976, and that’s what a 0.7 Sharpe ratio does.” But living through those periods takes — subjectively, and in wear and tear on your internal organs — many times the actual time it lasts. If you have a three-year period where something doesn’t work, it ages you a decade. You face immense pressure to change your models, you have bosses and clients who lose faith, and I cannot explain the amount of discipline you need.”

I think Rohit Sharma and some quant fund managers have aged by a year this quarter. Not Virat Kohli though. He is supremely fit. But he also seems like an algo gone wrong which keeps doing the same thing over and over again expecting different results. At some point, the adults in the room will have to use the kill switch. But coming back to regular humans, we did age and it shows.

Ace investor and trader, late Rakesh Jhunjhunwala used to say, “Vadhare vadhare levanu ane gathare gathare vechvanu.” Loosely translated to buy a stock on the way up and sell it if it is on the way down. However, most humans are inclined to do the opposite. They love a bargain and a stock which was available at 400, is now available at 300, is a bargain if it is available at 200 it’s a season sale and if it is available at 40 then it’s the offer of a lifetime.

In 1975 the Buffett group met at the Hilton Head where Bill Ruane (Sequoia) showed a chart of gold which for five years had surged past Berkshire Hathaway’s returns. He jokingly asked whether he should be buying the metal instead of equities. Henry Brandt pulled Buffett aside and asked him to promise that the stock wouldn’t fall below $40. By October 1975, the stock was down by almost 50% after trading at $93 just two years ago. Brandt called Walter Schloss who gave him a two-hour talk on why he should not sell his stock. However, by then the US economy was in so much trouble and the country was in such a mood of pessimism that it affected investors’ decision-making ability.

Buffett had wound up his partnership by 1970 and the partners who decided to stay back were given Berkshire stock at $40 and by 1975 they were at the same level. The late Charlie Munger said, “To anyone who held our stock it looked like not much was happening favourably for a long long time. And that was not the way our partners, by and large, had previously experienced things. The paper record looked terrible, yet the future was gaining all the while.”

Buffett’s net worth had fallen to the level of when he had closed his partnership. But how many many investors think in years today let alone five years or more?

Risks and Outlook

The first half of 2025 will perhaps be one of the most news-heavy and perhaps volatile parts of the year. Globally the US markets are doing well but may just be getting to a point where we can see a sell-on news correction at any point. The US economy is strong, and so are unemployment numbers but inflation is sticky. This gives the Federal Reserve very little room if any to cut rates. Trump brings along with him a lot of rhetoric around tariffs, immigration and America First. He is a businessman who believes in making a better deal for his country. The first six months of this administration will be watched closely.

Domestically things are getting slow. The Sep 24 quarter earnings gave us an indication of a slowing down economy and the GDP number of 5.4% was 1% below consensus. The budget may not have much in the way of cheer for markets and taxpayers.

Mid and Small caps did much better than large caps this quarter. However, they are still quite overvalued and there is more scope for correction here. Some of this started in January and intensified post-Jan 20 when “The Donald” was officially back in the White House.

Large caps were also a story of two halves. Nifty 50 by itself wasn’t too weak. The pain was in Nifty Next 50 which is considered to be more like a mid-cap than a large-cap index. While the Nifty 50 has corrected by 12%, the Nifty Next 50 has fallen by 19% from peak till date.

Core+Satellite

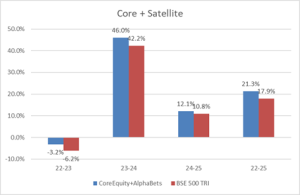

We had launched Core Equity in 2022 with the idea of completing our solutions. Core Equity is a large and mid-cap tilted strategy giving exposure to value/quality, low volatility and momentum and AlphaBets is a mid and small cap tilted strategy given exposure to risk adjusted momentum. Investing in both these strategies equally would have worked out well for the investor and the purpose was served as the bar chart shows.

An equal weighted combination of both these strategies would have beaten the benchmark index every year (post fees and transaction expenses and no expense assumed for the benchmark which at minimum would be about 50 bps). If we assumed 50 bps expense for an index fund then alpha generated would have been about 3.8% p.a. This is a good outcome given we had a sideways year in 22-23, a upward trending market in 23-24 and a roller coaster of a year so far in 24-25.

Performance

Core Equity strategy tilted towards large and mid-caps clearly had a bad time this quarter but it was not something that we have not seen in our back tests. A back test though is like watching the score on ESPNcricinfo after the match is over. There is no emotion involved because the outcome is already known. We have also implemented a layer of additional risk management to take quick action as the markets are very volatile and in risk-off mode. It is time to focus on preserving gains and capital.

AlphaBets is currently in its 4th consecutive year of positive returns. We hope to end the year positively there, but these are markets and there are no promises. When underperformance or drawdown occurs in real time it is painful. But if history is any guide, this is usually a mean reverting pattern or as the commentators would say, it’s time the law of averages will catch up.

Happy New Year to all. Stay safe and take care. Thank you for investing with us.

QED Capital, January 2025