““Do not spoil what you have by desiring what you have not; remember that what you now have was once among the things you only hoped for.”

Epicurus, Greek Philosopher, (341–270 BC)

Investing is often seen as a purely intellectual endeavour, but nothing could be further from the truth. Temperament and behaviour play as much of a role if not more in an investor’s success or failure. If that were not true, the best analysts would be the most successful investors. The two most common behaviour patterns that humans display are greed and fear. As a species, homo sapiens have survived due to survival instincts led by fear. The current world doesn’t have many of the dangers that our ancestors faced, but our brains are still wired to be aware of those fears. It is the most dominant trait which is why humans tend to overweight negative information compared to positive news. This is what leads investors to overreact to bad news, under-react to good news and look for patterns where there are none. At the beginning of CY 2023, the average forecast for the S&P 500 Index was negative for the first time since 1999. In 1999 and 2023 the index returned 21% and 26% respectively.

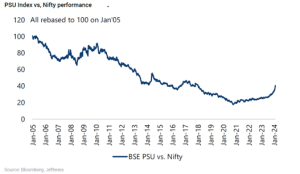

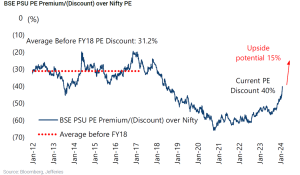

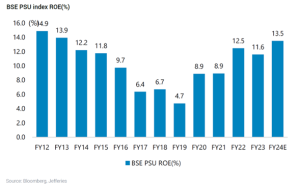

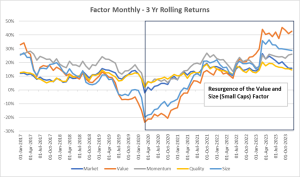

CY 2023 began with the Hindenberg saga which roiled Indian markets and the mini-banking crisis in the US. However, the market bottomed out by Jun and began rising from there. The Value factor continued its up move via a sector and theme i.e. the SOE – State Owned Enterprise. This sector has flattered to deceive many a time in the past but this time around it seems to be more than just a cyclical up move. The experience of previous cycles as shown in the charts below caused most investors to dismiss the move as transitory. To be fair the SOE space has been attractive solely on valuations for a while now but a trigger for rerating was missing.

We are somewhere between the 4th and 5th stage. The wisdom of crowds however reigned supreme. It will no doubt go through its various gyrations and shakeout and pullback phases. No sector, company or market ever goes up in a straight line. But if there is more money to be made here, our systems and the rules-based process will ensure we participate.

Using the factor lens, the move in SOEs is visible through the Value and Size factor. The Value factor started its move in Oct 2020, just when the vaccine had been announced and since then has been on a tear. The move has also been pronounced in mid and small caps.

But I digress a bit. Having a systematic process, however, is not enough. One has to follow it in tough times as well as when the going is good. There may be temptations to override rules to take profits early or hold on to losing positions in the hope that they may rebound but that does not work over the long run.

In a recent tragic accident, a Japanese Coast Guard Dash 8 plane struck a Japanese Airlines (JAL) plane on landing. All the 379 passengers and crew members of the JAL plane “miraculously” survived. This boiled down to the ability of the crew members to follow the safety procedures and rules during evacuation and for the passengers to follow them in a life-threatening situation. It was a devastating tragedy 40 years ago that helped JAL implement stringent safety procedures and training to make it one of the safest airlines. A CNN article, How safety rules ‘written in blood’ saved lives in Tokyo plane crash, stated, “As JAL employees know all too well, modern aviation’s safety records are written in the blood of others who haven’t been so fortunate.”

So is systematic investing rooted in the mistakes and near misses of not following the system in times of utter panic and chaos when it is most needed. You don’t need to be Captain Spock, but you do need to follow the system and rules in good times and bad. Investing, whether discretionary or systematic, is not emotionless, however using rules and systems one can reduce the emotional element in executing your investing process, which is the outcome of your investing philosophy. You have to be like Ulysees, and when the sirens come calling, you have to tie yourself to a mast and resist the temptation to override the process. However, the easiest person to fool is one’s self. Michael Kemp in his recent book “The Ulysses Contract—How to Never Worry About the Share Market Again” says that “Too many people simply assume that they have the skill that it takes to be a successful investor. It’s a worldwide delusion on a mass scale… countless stock market punters reckon that they’re in with a chance to emulate [Jim] Simons or [Warren] Buffett when it comes to investing.”

Risks and Outlook

Inflation is cooling down in the US and India, both central banks are however still in a holding pattern. They don’t want to be in a hurry to cut rates but the US 10 yr was trying to front run the Fed, however, the Feb 24 CPI has been an unpleasant surprise and the US 10 yr has pulled back to 4.2% from 3.8% where it was before the Feb CPI print.

The second risk is geo-political. We have two major elections this year – one is our own Lok Sabha election and the second is the US presidential election in November. Any surprises here from the consensus expectation and one could see a strong reaction from the market. The long-term trend will not change but there can be a transitory period as investors adjust their priors.

There is also a growing narrative that prices and valuations outside the large cap space may have run ahead of themselves. Nothing grows to the sky and that is true for markets and life. So we may witness some pullbacks and shakeouts in the sectors and themes that have done extremely well in a very short period. That is to be expected. Volatility which was quite low last year has spiked from about 10% in September 23 to 15% in December 23.

Performance

*The performance related information provided here in is not verified by SEBI

We are also happy to report that AlphaBets finished in the top quartile of one-year and two-year returns (from 811 investment approaches) as calculated by APMI . We also featured in the list of 22 PMS schemes that gave double digit returns in January 2024.

Stay safe and take care. Thank you for investing with us.

Regards,

Anish Teli and QED Capital Team, February 2024

To know more about our investment philosophy and strategies, please share your details on https://qedcap.com/contact/

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.