“Fundamental analysis seeks to establish how underlying values are reflected in stock prices, whereas the theory of reflexivity shows how stock prices can influence underlying values. One provides a static picture, the other a dynamic one.”

George Soros

There was a common competition in the 1930s male dominated financial circles in London: picking out the prettiest faces from a set of photographs. John Keynes, likened professional investors to this multilevel guessing game. “Professional investment may be likened to those newspaper competitions in which the competitors have to pick out the most prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice most nearly corresponds to the average preferences of the competitors as a whole: so that each competitor has to pick, not those faces which he himself finds prettiest, but those which he thinks likeliest to catch the fancy of the other competitors, all of whom are looking at the problem from the same point of view.”

Most “value” investors are trying to buy stocks where they think “Mr. Market”, Ben Graham’s term for Keynes’ “other investors”, is wrong and sooner rather than later, Mr. Market will change his view. Growth investors believe, Mr. Market doesn’t appreciate the growth that the company is likely to achieve in the future. And they believe that Mr. Market will come around to their view.

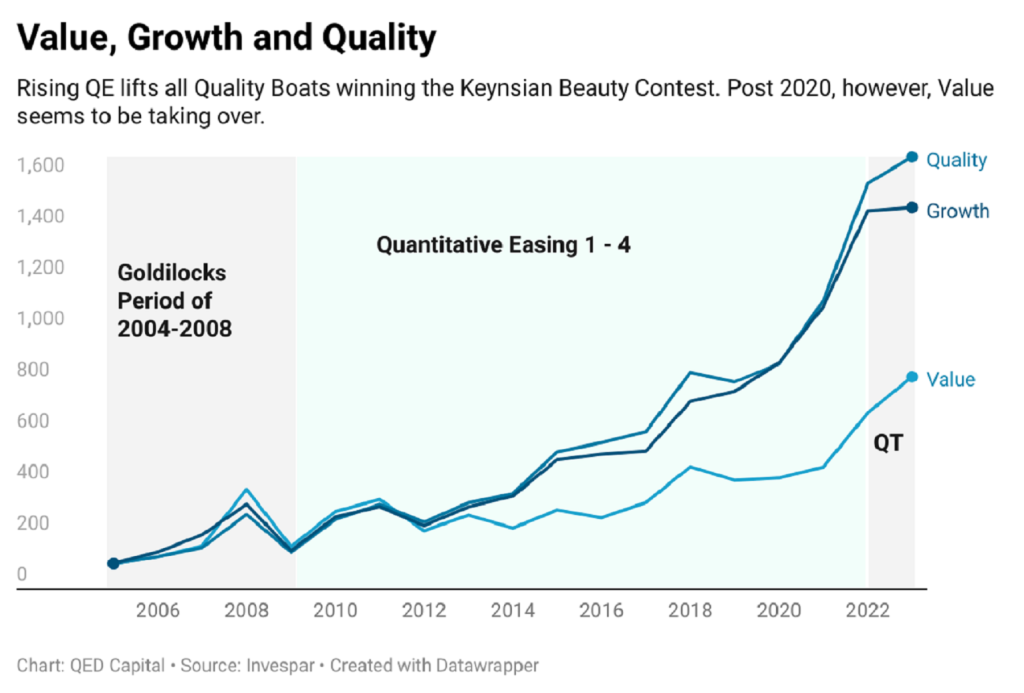

For over 12 years beginning the 2008 Great Financial Crisis, when easy money and liquidity flooded markets, it was quality stocks that took center stage. In an era of high risk averseness, easy money and narrative about Quantitative Easing would go wrong, saw a massive flight to quality. That may now be reversing. Over a period of time quality became quality at any price or “Buy at any price” (BAAP) stocks as they were popularly named in media. This was similar to the “one decision stock” phenomenon of the 1970s in US. Burned by companies with high leverage, which suffered in the Great Financial Crisis of 2008, investors took safety in quality stocks with zero or low debt. Companies with strong ”moats” which were usually consumer franchises, started getting bid up. The phenomenon as is with the reflexivity principle of George Soros, went on for too long. P/E multiples could no longer be justified, so Graham’s “margin of safety” became a much abused metric where investors would calcuate their own intrinsic value and compare current price to that. It worked like a charm for over 10 years though.

Keynes was also of the view that professional investors would not play the role of “smart money”. Infact they were more likely to go with the crowd because of career risk. As he said, “worldy wisdom teaches us that it is better for reputation to fail conventionally than to succeed unconventionally.” Most of them turn out to be closet index huggers. They live and die by the benchmark they hug.

Keynesian Beauty Contest – Mirror Mirror on the wall, which is the most profitable factor of them all.

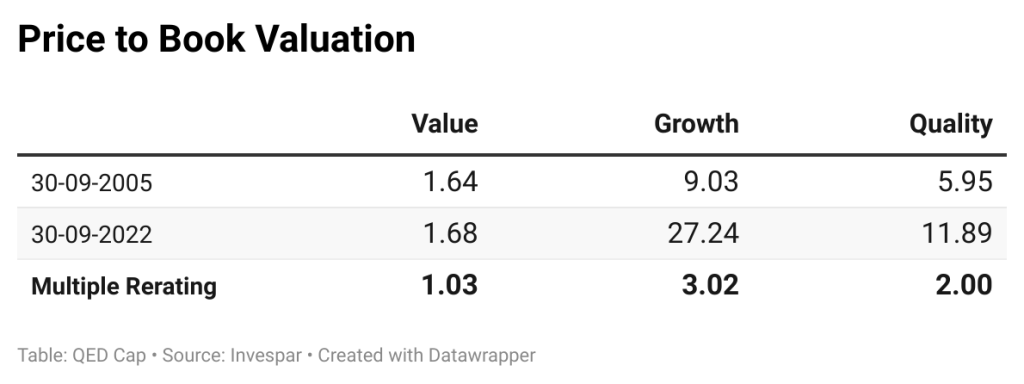

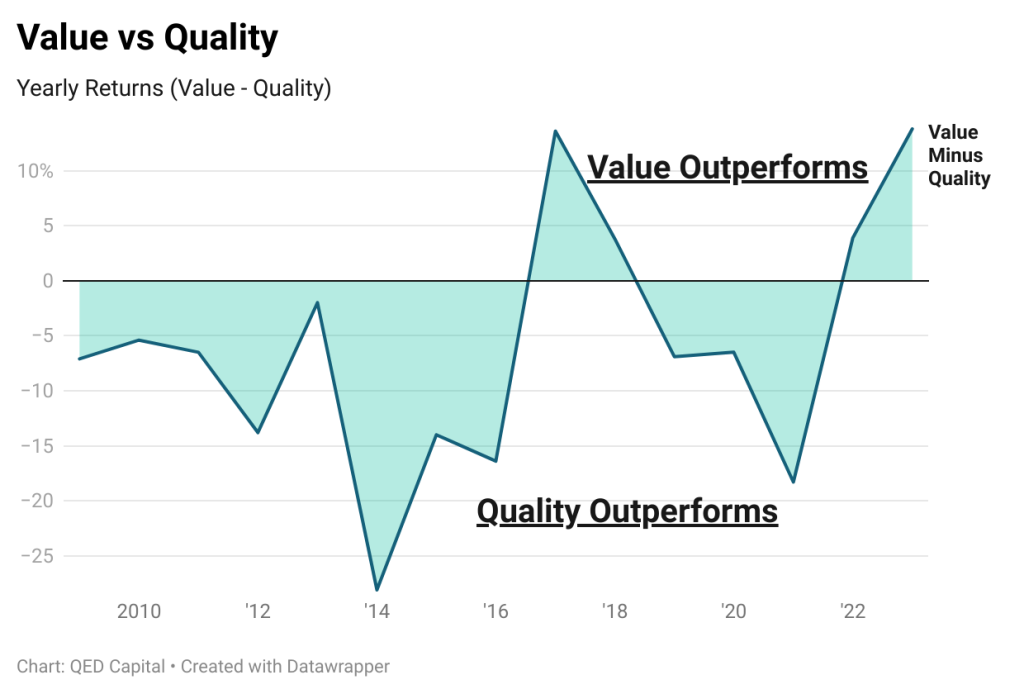

As the table below shows, the valuation rerating in Quality stocks was almost 200% or 2x of what they were in 2005. Growth stocks have been bid up to almost 300% or 3x of what they were in 2005. Value on the other hand, is still where it was in 2005. Some explanations like intangibles and brand value are often touted for the higher valuation of Quality stocks. But do these companies deserve a 5-10x the valuation of Value or non glamour stocks, is a question that has been asked many a times. In the post QE world, where real and nominal rates have reverted to mean or are on course, a derating in valuation of Growth and Quality names seems to have started. The outperformance of the Value factor in the last two years is perhaps the canary in the coal mine for Quality and Growth stocks.

In 2016, Value did rear its head only to be put back down again. However, now it does look that the factor has gained momentum, and Value’s outperformance, as it did in the post dotcom era, may have just begun.

Nifty-Fifty – A good company is not always a good investment or stock

In the 1970s in the United States, there was a phenomenon of the “Nifty Fifty” (not to be confused with our Nifty 50 benchmark) stocks also called “one decision stocks”. These included great franchises like Xerox, Polaroid, McDonald’s, Coca-Cola and IBM. The average P/E ratio pf these stocks (which featured in the Kidder Peabody/Morgan Guaranty list) was 42x vs the S&P’s 19x. What happened next is a tale told often. Most of these names fell anywhere from 60-90%, in the 1973-74 bear market. They recovered and gave index returns over the next 26 years. However, I doubt many investors would have held through 60% drawdown or had the patience to wait 26 years. Professor Jeremy Siegel proposed two theories. He said, “The first is that a mania did sweep these stocks, sending them to levels that were totally unjustified on the basis of prospective earnings. The second explanation is that, on the whole, the “Nifty Fifty” were in fact properly valued at the peak, but a loss of confidence by investors sent them to dramatically undervalued levels.” Something similar happened recently with the FANG stocks (Facebook, Amazon, Netflix and Google).

Revenge of the value nerds

Last word to Daniel Loeb of Third Point. “I tend to be more of a bottoms up analyst but 2023 should prove to be a year of a battle of two narratives. Rates and inflation on one hand versus GDP growth, margins and ultimately earnings on the other. Markets will be further determined by participant’s outlook from current company performance versus ’24 and beyond. I don’t think camping out in the last decade’s darlings, with rosaries in hand, hoping for a comeback, will be the winning strategy. We have already seen the revenge of the value nerds. I think more to come. This was a framework to think about the market and economy not a prediction. That’s up to you.”

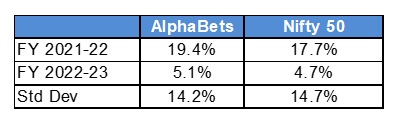

Performance

The markets were choppy this quarter. Markets went up in October 22 but gave back the gains in December 22. Data globally shows that inflation may have peaked (not reversed), the real economy and employment have started responding to higher interest rates. If indeed there is a recession in CY 23, markets will discount them in advance, and move on the next “most important trigger”. We will continue to follow our process and are confident that irrespective of whether Value or Quality reigns, we should be participating in it.

Wishing your family and you a very happy new year and thank you for reading!

Stay safe and take care. Thank you for investing with us.

QED Capital, January 2023

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.