“It is better to live your destiny imperfectly than to live an imitation of somebody else’s life with perfection.”

Bhagwad Gita

The above quote speaks to the importance of authenticity and personal journey, which aligns well with the unique paths taken by three legends all of whom we lost recently, namely, Charlie Munger, Daniel Kahneman, and Jim Simons.

Munger, Kahneman and Simons represent the convergence of academia and practical application in their respective fields, each bringing a unique perspective that has significantly influenced both the theory and practice of investing.

Charlie Munger, known for his partnership with Warren Buffett at Berkshire Hathaway, embodied the role of a practitioner with the depth of an academic through his profound understanding and application of investment principles. Munger’s investment philosophy was built on the importance of long-term thinking, recognizing the value of companies with strong competitive advantages or “moats,” and a relentless commitment to continuous learning and rational thinking. Investment decisions, such as those involving See’s Candies, Coca-Cola, and BYD, showcase his ability to apply a multidisciplinary approach, blending insights from various fields to guide his investment strategy. However, if there was one learning to take from his many insights – it would be “Invert always invert” which he would interpret as tell me where I am going to die and I will never go there. As systems-driven investors, we can learn to disprove our models. If a model survives the test of the fact that it cannot be rejected that would be a far more robust test than the fact that it works.

Daniel Kahneman, a Nobel laureate in Economics, brought the insights of a practitioner to his academic work, particularly in the field of psychology. His research on cognitive biases and heuristics has been fundamental in understanding human decision-making, influencing areas ranging from economics to policy-making. Kahneman’s work underscores how systematic errors in thinking can affect decisions, highlighting the importance of heuristics and biases in economic behaviour, which have practical implications for both individual decision-making and broader economic theories. Kahneman’s key insight was individuals become risk averse when it comes to protecting gains and risk-seeking when faced with a situation where they have to minimize their losses. In practice, it should be the opposite. Ricardo said it many years ago that let your profits run and cut your losers fast. Kahneman proved it.

Jim Simons, who founded Renaissance Technologies, stands out for his application of mathematical models to finance, particularly through algorithmic trading. His approach combines his academic expertise in mathematics with the practical demands of financial trading, creating highly sophisticated models that predict price changes in financial instruments. Simons’ success in quantitative investing not only revolutionized the field but also demonstrated the powerful impact of blending scientific methods with investment practices. The existence of Simons who himself came from a non-finance background and never hired from Wall Street proved that if you want to beat the market, you have to be different from it and apply common sense. It is perhaps a supreme irony that the “man who solved the market” never used finance theories to do that. He used theories from other disciplines like natural language processing, statistics and astrophysics. This underscores Charlie’s main point about having a latticework of mental models to view and understand the world.

These figures represent a profound blend of theory and application, where academic insights meet practical execution, shaping their fields in significant ways. Their lives and teachings offer valuable lessons in persistence, interdisciplinary learning, and the application of theory to practice, which are influential across various domains.

The Year’s Analysis

The year started on a fairly strong note in the FY 24 April – June quarter but flattened out post that. It picked up steam again in November 23′ and that continued on December 23 and January 24. The year belonged to PSU stocks in all sectors. After nearly a decade of underperformance, PSUs were back to the party and were leading it by a big margin. While there has been a decent recovery in ROEs and margins of PSUs, it remains to be seen whether this will continue to be sustained in the future or if this was a turnaround phase.

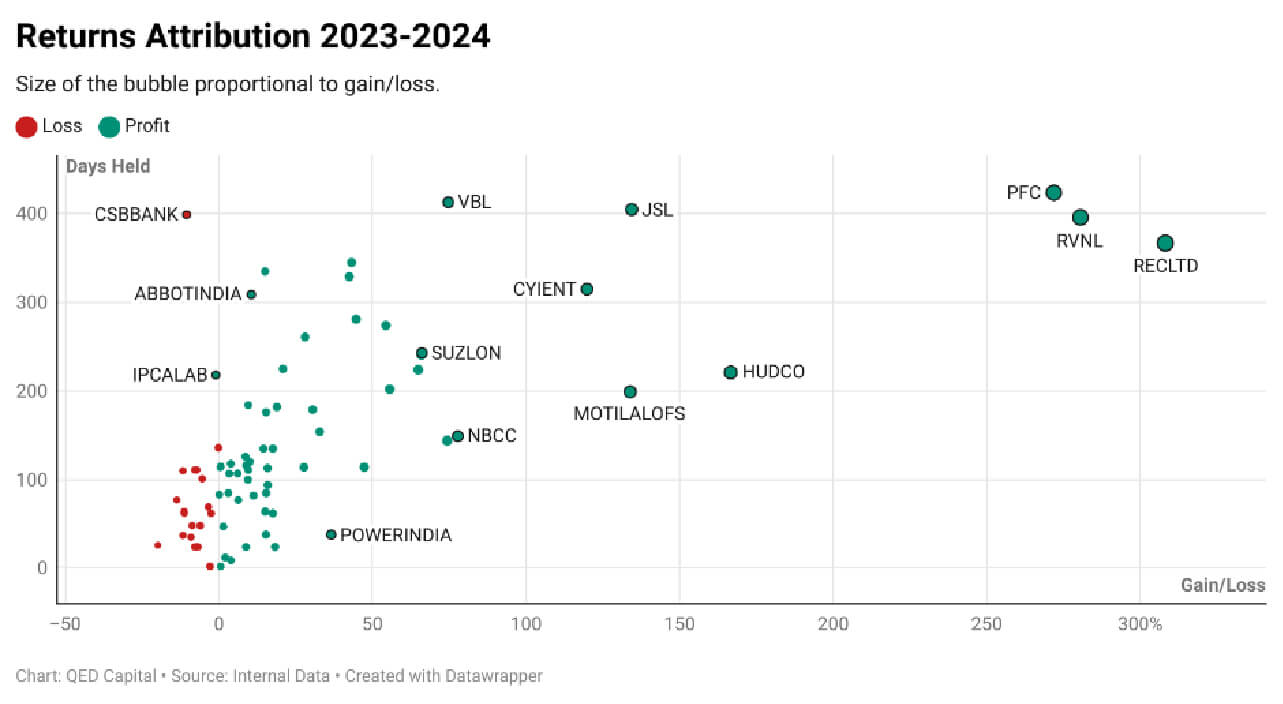

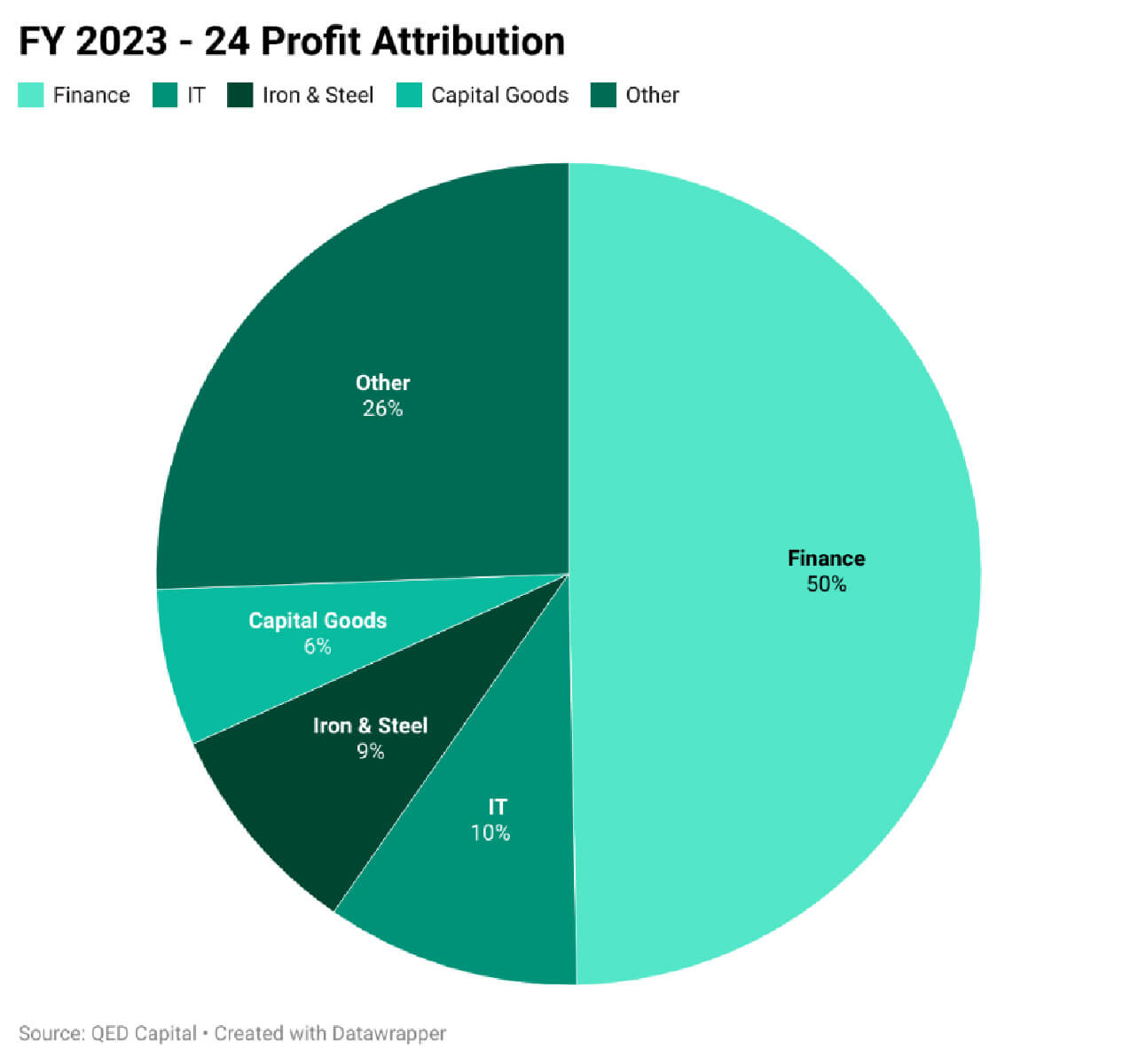

Our biggest winners in AlphaBets were, no prizes for guessing, PSU stocks. PFC, REC, and RVNL were among the biggest gainers followed by HUDCO and NBCC. Some of the non-PSUs that did well for us this year were Varun Beverages, Suzlon and JSL among others.

Performance

It has been a very good year for equities especially in the small and mid cap segment. There were some volatile months but the overall trend remains up. Markets do not go up in a straight linear line and at some point in time small and midcaps will either correct and revert back to mean or large caps will out perform and catch up.

Year Ahead – Risks and Opportunities

It promises to be a very interesting year ahead with elections in two of the world’s largest democracies. We will however, tune the noise out and follow our process and that has served us well in the past.

Stay safe and take care. Thank you for investing with us.

Regards,

Anish and QED Capital Team, May 2024

To know more about our investment philosophy and strategies, please share your details on https://qedcap.com/contact/ and we will connect with you.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing. The performance-related information provided herein is not verified by SEBI