“Short term volatility is greatest at turning points and diminishes as a trend becomes established.”

George Soros

Volatility and risk, in the realm of investing, are intricately woven into the fabric of the financial markets. Much like George Soros’ perception of market reflexivity, where the actions of market participants influence the fundamentals, volatility is a reflection of the collective psyche of the investor community. It embodies the ever-changing moods, sentiments, and expectations of the market. However, with volatility comes risk—the uncertainty of returns. But as Soros would likely opine, it is within this very uncertainty that opportunities are born. For the astute investor, understanding and harnessing volatility, rather than fearing it, can lead to the potential for remarkable gains. It is a dance with chaos, where the rhythm of the market if correctly interpreted, can lead to a symphony of success. Between 1962 and 1975, Charlie Munger’s partnership returns were highly volatile but it beat the index by 3x with a volatility of 2x. It also had two back-to-back years in 1973 and 1974 where it had over 30% negative returns each year and underperformed the index but then recovered in the third year.

By 1975, the investors who were able to withstand the gut-wrenching ride were able to grow their capital to 12x vs 2x for the index. But how many would have stuck with such an investor in today’s day where most have very short attention spans and want a smooth ride?

Amidst the ebb and flow of volatility lies the concept of “noise” in investing. Noise refers to the plethora of information, data, and sentiments that may not have a direct bearing on the intrinsic value of an investment but can influence its short-term price movements. This cacophony of distractions often amplifies volatility, as traders react to fleeting news or rumours, causing equity prices to sway disproportionately. Distinguishing between genuine signals and mere noise is a challenge even for seasoned investors, underscoring the need for a firm, analytical foundation in investment decisions.

Now think of a scenario where god or a messenger from heaven above arrives on earth with perfect foresight and tells you what to buy and hold for the next five years. So we did that exercise. And guess what – even if you have perfect foresight for the next 5 years and know which stocks will perform the best and buying and holding them for 5 years will give you stupendous returns, you will not be able to avoid volatility.

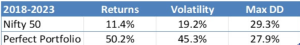

We ran an experiment with “perfect foresight” from March 2018 to March 2023 and picked 40 of the best-performing stocks from the Nifty 500 universe. The returns of this “Perfect Portfolio” were almost 5 times that of the Nifty 50, but the volatility was almost 2 times. Investors find it hard to stomach volatility in the Index, so staying the course, even with perfect knowledge might be a tough one

In the book “Finite and Infinite Games” by James P. Carse, he says and I paraphrase – “In the stock market, as in life, there are those who play for the immediate win, bound by short-term gains and losses—a finite game. Then some play the infinite game, where the objective isn’t to win or lose, but to keep playing, adapting, and evolving, understanding that the market’s dance is a perpetual one.” This encapsulates the distinction between short-term market movements and long-term investing, resonating with the book’s central theme of distinguishing between finite games (with a clear endpoint) and infinite games (with an ongoing, evolving nature). Those who understand that short-term volatility is a feature and not a bug in long-term investing, are playing the infinite or the long-term game.

Calm Before the Storm

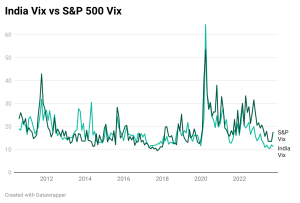

Volatility is inevitable. It is also the only aspect of a portfolio, which is somewhat in an investor’s control. Returns, correlations, drawdowns and other such aspects are completely left to markets. Currently, however, a unique phenomenon is occurring in the Indian equity markets. India Vix which is a good proxy for how volatile the market is expected to be in the near future, is perhaps at an all-time low. At the same time, the S&P 500 Vix is much higher than India Vix. While this has happened in the past, it seems to have become a strong trend now.

As the chart below shows, India Vix is currently at an all-time low and it has puzzled many a market investor and option traders. Directionally while S&P 500 Vix seems to be headed up, India Vix is still pointing to lower levels (if that is even possible). Narratives can be built around this but there is still no one convincing theory for this phenomenon to occur. Has India become a low-beta defensive market for FIIs or is it the MF SIP inflows which is keeping volatility in check is anyone’s guess.

Risks and Outlook

Media, especially social media has a primary feature – anger and outrage. In the global town hall, darkness and pessimism rule as they attract more attention than positive and constructive thoughts. This quarter it’s all about China, US Yields spiking and unemployment numbers staying strong. Although the double job theory is coming into play for the latter. Many people are holding two jobs to keep up with rising prices due to higher inflation.

In the last 6 months, the US Treasury has borrowed ~ $801Bn while the US Fed has reduced its balance sheet by $584Bn. This is one of the largest divergences on record since the Fed began unconventional bond purchases in 2008. To add to that China’s holdings of US Treasuries continue to fall sharply. Since April 23, China has sold over $40 billion of US Treasuries.

Since their peak roughly a decade ago, China has unloaded nearly $500 billion of US Treasuries. One of the possibilities is a potential slowdown of their economy. Another is that this could be part of a broader strategic shift. Regardless, this is a trend you can’t ignore.

“When you see something occur in a complex adaptive system, your mind is going to create a narrative to explain what happened—even though cause and effect are not comprehensible in that kind of system.”

Michael Mauboussin

The US bond markets are facing a situation like equity markets did in 2008. However, the fear has not yet fully spread into equity markets. US equity indices are 15% away from their all-time highs while bonds are down 50%

(Source: Datatrek, The Worst Bond Bear Market in History by Ben Carlson)

Will this cause disinflationary pressures to rise and cause the most awaited recession to finally arrive? Or are we already in a stealth recession? We don’t know and we try not to worry about this noise. Markets, in essence, are “complex adaptive systems” – they evolve, adapt, and react to multifaceted stimuli. This complexity means that outcomes are often non-linear and can diverge widely from conventional wisdom or predictions. The events of 2008 stand as a testament to this. Amidst the financial turmoil, many Nobel laureates and esteemed investors posited that the aggressive Quantitative Easing (QE) measures would usher in rampant hyperinflation in the US. However, contrary to this widespread belief, hyperinflation never materialized. This divergence from expectations underscores the intricacies of markets, where interwoven variables, feedback loops, and emergent phenomena often defy straightforward forecasts. It serves as a poignant reminder that humility and adaptability are paramount in navigating the capricious seas of investment.

Performance

This was yet another excellent quarter for equities, especially in the mid and small-cap segments. The data below for FY 23-24 is up to the Sep 2023 quarter calculated on a TWRR basis. PSU, Power, Defence, Mid Cap IT and Infrastructure themes lead the rally this quarter. October is traditionally a volatile month and let us see how it ends.

*The performance related information provided here in is not verified by SEBI

We are also happy to report that AlphaBets finished in the top quartile of one year returns as calculated by APMI (Association of Portfolio Managers of India).

Stay safe and take care. Thank you for investing with us.

Regards,

Anish Teli and QED Capital Team, October 2023

To know more about our investment philosophy and strategies, please share your details on https://qedcap.com/contact/

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.