“A quick way to tell if a stock is overpriced is to compare the price line to the earnings line”.

Peter Lynch

In our Dec 2018 quarter review, we wrote about how Ralph Wanger, author of “Zebra in Lion Country” and the portfolio manager of the Acorn Fund, likened the market to an excitable dog on a very long leash in New York City, darting randomly in every direction. He said, “The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any moment, there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all the market players, big and small, seem to have their eye on the dog, and not the owner.”

Financial blogger Ben Carlson writes that Bob Maynard’s, CIO of the $21 billion Idaho Public Pension, entire approach is based on the premise that increased complexity is failing professional investors. Instead of fighting complex markets with complex strategies, Maynard favours a simpler approach, as he states in a write-up for Chief Investment Officer:

However, a complex investment world does not require a complex response, either like the investment organization or the particular investment strategies chosen.

The cockroach lives in a highly complex environment with one of the best long-term success rates of any creature. Yet it has only one defence mechanism – running in the opposite direction from a puff of air. The equivalent for the investment world is, at the core, a straightforward structure founded upon public market diversification with one basic defence mechanism: see a volatile movement and react in the opposite direction (i.e. rebalance into it). A simple structure and strategy, if adhered to, has one of the best chances of surviving for many decades.

Price is slave of earnings over the long run. In several of Peter Lynch’s old books, he shared a charting technique later dubbed the “Peter Lynch Chart”. Multiples may expand or contract every year but over a longer period, they will find a fair value. That is the ultimate truth. Whether your style of investing is systematic rule-based like ours or discretionary like others. Both need to have a process with an edge.

Maynard focuses on the owner, but most investors are preoccupied with the dog. It’s easy to say you should ignore the noise in the markets, but this is nearly impossible in today’s world because information is all around us. Your plan should include ways to eliminate the amount of noise that finds its way into your portfolio, even though you’ll never be able to completely escape it. The trick is being able to sift through the noise and figure out the difference between what’s actionable and what’s entertainment.

This is why portfolios should be managed for risk, not returns, a simple yet important distinction.” Peter Bernstein wrote in his brilliant book Against the Gods ––“Survival is the only road to riches. Let me say that again: Survival is the only road to riches. You should try to maximize return only if losses would not threaten your survival and if you have a compelling future need for the extra gains you might earn.”

As data for the Nifty Indices below shows the index level has grown at almost the same pace as profits of the underlying companies. However, adjusted for BFSI, Market Cap growth has been much higher than earnings growth. The opposite is true when BFSI is included, and the Metals and Oil and Gas sectors are excluded.

Risks and Outlook

Inflation is cooling down in the US and markets are pricing in a rate cut in Sep 2024. While the election uncertainty is behind us in India, we still have the US election to look forward to in November 2024. Donald Trump seems to be the front-runner by a long margin, but it’s not done until it is done. Joe Biden has now officially dropped out of the race to become the presidential nominee of the Democratic party where the cat is among the pigeons now.

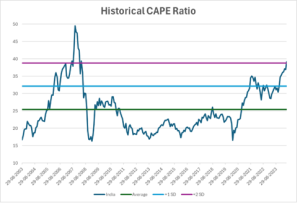

There are pockets of exuberance in the markets while some pockets appear attractive. There is a fair amount of concern and worry that the markets have run ahead of themselves. Being bullish at this point is almost a contrarian view. The Historical CAPE Shiller Index is at standard deviations away from its long term mean which means return expectations in the long run should be moderated. However, this has no bearing on the what will happen in the short to medium run.

As we know, far more money is lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves. At the same time, it is important to keep our expectations in check. It is highly unlikely that we get similar returns in the next 3-5 years to what we have received in the past 3 years. The stocks that have led this rally, like PSU Banks, Defence, Infrastructure etc., were coming off a very low base and expectations from this pack were very low and most investors had lost faith in them. That seems like a distant past now. Hence, we keep working on our process and executing the system.

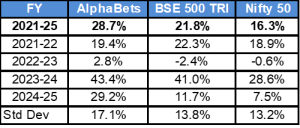

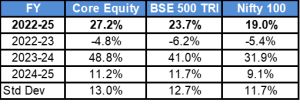

Performance

It has been a great quarter again for equities and AlphaBets in particular. Core Equity has also performed in line with markets this quarter and is outperforming the broad benchmark and large cap index since inception. It would be reasonable to expect some amount of sideways or downward correction in markets during the year ahead.

*Core Equity returns are from July 2022 onwards. The performance-related information provided herein is not verified by SEBI

Remember every past drawdown looks like an opportunity and every future correction is a risk. However, if you are in this for the next decade, a couple of quarters should not be the horizon on which you measure returns.

Stay safe and take care. Thank you for investing with us.

Regards,

Anish Teli and QED Capital Team, July 2024