“Everyone once in a while we get a market where some new investors learn old lessons”

Warren Buffett

It has been an interesting quarter for sure with geopolitics taking centre stage. The Fed’s well-telegraphed decision to cut rates was well-received by markets but very few were expecting 50 bps cut. Now political motives are being attributed to this. Interest rates have been at the centre of discussion over the last two years since the collapse of Silicon Valley Bank. The calmness in the market has been underscored, however, by uncertainty around employment and inflation expectations in the US economy. This is well reflected in the Fed Fund Futures Price as shown in the graph below.

Even after a 50 bps cut in the Fed Fund Futures rate, the 10 yr and the 30 yr end of the curve have moved up.

On the weekend of 29th September, political upheaval in Japan caused the Nikkei to plummet by almost 5%. Since then the Japanese index has moved sideways. The most important or impactful action in this quarter however was the “whatever it takes” statement from the Chinese political establishment. This is compared to the statement of ECB’s former chairman, Draghi, in 2016. The Hang Seng Index (a proxy for the Chinese market) has done about 15% since the announcement and Chinese stocks listed on US exchanges are much in demand. Whether this turns out to be sustainable or not remains to be seen. Buffett in the meantime has been selling his stake in Apple and shoring up his already large cash reserves.

While investors are all about the long term, currently they are like a cat on a hot tin roof. One reason put forth is that certain trends in the markets are now almost 24-36 months long and are seen to be running their course or taking a pause. About 50% of Mutual Fund investors in India have entered the market in the last 3 years. This is their first rodeo. The monthly SIP numbers in India tell us that the Indian retail investor thinks long-term. Or do they? The media usually plays up the gross flow number whereas what matters are net flows.

Mag Seven in the US, Value Factor both in the US and India, and inflation are cooling down. If there is a soft landing into a recession or a global slowdown, investors want to reposition themselves to take advantage of it. The US presidential election is an overhang, and investors want to be ready for either candidate. Hasn’t history shown us that in the long run what matters to stock performance are long-term earnings trends? The long-term India story and US innovation trend are well set. There seem to be no major indications to the contrary.

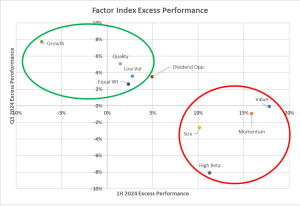

September 24 quarter saw a reversal not just in the best-performing sectors and factors aka investing styles, but also in the fortunes of the Indian cricket team. After a disastrous 46 all out in the first innings at Bengaluru, against New Zealand, India lost the test match against the black caps. This was followed by an even more disappointing loss in Pune. Like the mega caps of the Nifty, the mega caps of India’s batting lineup – Rohit Sharma and Virat Kohli – have lost momentum. That is however the approach of this team. They will go for results and in that, some tough periods like this will have to be endured. The graph below shows factors like value and momentum that outperformed in the H1 of CY24 and underperformed in Q3. Like the Indian team (which won the T20 World Cup in June and is now losing at home), factors that did well in H1 have underperformed in Q3.

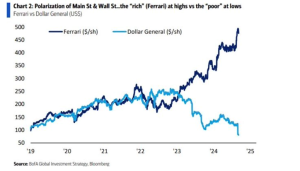

Charlie Munger said if you understand everything about the economy, that means you don’t understand much at all. The recovery globally and in India seems to be a “K” shaped one. The chart below by BoFA gives a good visualization of that. In India too, Hindustan Unilever and Nestle’s commentary was similar. They are seeing growth and strength in premium segments, but the middle class in urban areas are under pressure. This means that even Quality led by FMCG which was looking like a safe haven, has not had a great October.

We could have a fair amount of volatility or fall this year. That would be an opportunity if one was a long-term investor, but very distressing if the outlook or expectation was that one wanted consistent returns every month or even every quarter. The moral hazard of the central banks bailing out equity markets in 2008 and 2020 is playing out currently. Investors have become complacent, brokerage accounts have been opened at a blistering pace, any dip is bought into and even a 5% correction is called a crash (on social media at least). This fall in October though has seen intense selling by FIIs and DII buying has not been able to stem the fall. These are all signs that investors are nervous and current sentiment is weak. Their talk does not match their walk. If this continues for a while, we may see a situation where some new investors will learn some old lessons.

Risks and Outlook

It seems like a volatile phase will continue till the end of the year. Valuations are high and priced to perfection. Sector and Factor rotation is always a tricky time in the short term.

Geo-political tensions are on the rise. In February 2023, the Nifty 50 fell by about 5 per cent soon after news of the Russia-Ukraine conflict broke out. But from March 2023, in spite of the Middle East conflict continuing, the Nifty 50 has returned investors a handsome 40 per cent to date.

Warren Buffett (and Charlie Munger) said that the best way to make your marriage last forever is for both spouses to have low expectations. The same can be said for the “marriage” between an investment manager and their partners. In the next few quarters keep expectations low, focus on your day job and don’t pay attention to the market daily. It will be good for our health and wealth in the long run.

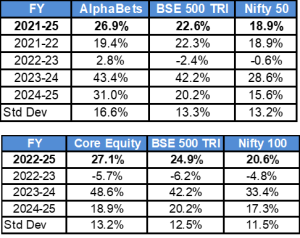

Performance

It has been a good quarter again for equities and AlphaBets in particular. Core Equity has also performed in line with markets this quarter and is outperforming the broad benchmark and large cap index since inception. October however hasn’t been so great so far. It would be reasonable to expect some amount of sideways or downward correction in markets during the year ahead.

*Core Equity returns are from July 2022 onwards. The performance-related information provided herein is not verified by SEBI

Remember every past drawdown looks like an opportunity and every future correction is a risk. However, if you are in this for the next decade, a couple of quarters should not be the horizon on which you measure returns.

Wishing you all a very happy and safe Diwali. Stay safe and take care. Thank you for investing with us.

Regards,

QED Capital, Oct 2024