“Patience is not passive. On the contrary, it is concentrated strength.”

Morgan Housel.

Indian Markets in Past Shocks

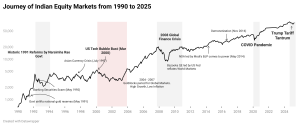

History shows that India’s equity market has endured and rebounded from severe economic shocks.

Let’s take the 2000 – Dot-Com Bust: Following a euphoric rise in tech stocks, the bubble burst hit Indian equities at the turn of the millennium. The Sensex, which had peaked around 5,800–6,000 in early 2000, tumbled nearly half its value over 2000–2001 as global tech demand dried up. The IT index fell 44% and rockstars like Infosys, and Wipro saw sharp corrections. Investor sentiment soured – memories of the 1992 scam and recent losses kept many retail participants on the sidelines. In 2003, the Sensex regained its pre-bust highs, powered by robust economic growth, IT services exports, and rising domestic investment. The early 2000s bear phase gave way to one of India’s strongest bull runs (2003–2007). Recovery patterns were evident: initial panic selling was followed by gradual bottom-fishing by value investors, then a broad-based rally as earnings improved. Those who remained invested through the dot-com bust and increased their equity allocation during the period eventually saw handsome gains when the market momentum returned. Compared to this period and the other past corrections, the current downturn is, so far, a blip on the long-term charts. The market will eventually figure out the winners of this period and they will slowly emerge. It is important to remain patient and wait for events to play out.

Post-Crisis Investor Behavior: Across these episodes, a common thread in investor behaviour emerged. In the acute phase of each shock, many investors overreacted – fleeing equities during the worst news – only to miss the sharp rebounds that followed. Conversely, disciplined investors had a plan and processes were vindicated. Time and again, the Indian market has demonstrated an ability to absorb shocks and rebound to new highs, reflecting the country’s underlying growth potential. The Sensex has risen nearly from 1048 in Jan 1991 to almost 80,000 odd right now – a staggering 80-fold in 35 years – a testament to long-term value creation despite intermittent crises where we had more than 10 occasions where the market has corrected more than 20%.

Current Headwinds: Trade Tensions, AI Disruptions, and Market Adaptation

Let’s now take a look at the current geopolitical and economic situation and some background on that.

The Mar-a-Lago Accords: a conceptual framework associated with former President Donald Trump’s economic vision which draws its inspiration from the 1985 Plaza Accord

- Broad-based tariffs to both protect domestic industries

- Link economic access to military alliances

- Advocate for a deliberate devaluation of the U.S. dollar,

- Restructuring of sovereign debt through ultra-long maturity instruments

Current Outlook – Risks and Opportunities

Let’s fast forward to the present. The global backdrop today presents its own set of challenges – albeit far less dire than in the 1930s – and the Indian market is once again navigating through uncertainty. Key concerns include trade disputes, technological disruption, and sector-specific slowdowns. Yet, as before, the market is in the process of repricing risks and adjusting, rather than collapsing. Let’s break down the current headwinds:

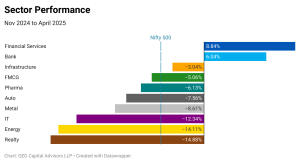

- Trade Tensions and Protectionism: In recent years, we’ve seen echoes of protectionist policies, from tariff skirmishes between major economies to efforts at de-globalizing supply chains. For instance, higher U.S. tariffs on certain goods have created volatility for export-dependent sectors. In a recent development, a steep 25–27% import tariff by the U.S. on select Indian products (a legacy of trade-war posturing) sent ripples through market sentiment. However, unlike 1930, these trade tensions are limited in scope and partly offset by new opportunities for India. Global firms are adopting a “China+1” strategy – diversifying supply chains to countries like India – which has led to incremental investment in Indian manufacturing and services. India, by staying relatively non-aligned geopolitically, stands to benefit from the supply-chain reorientation in the medium term. Thus, while short-term market jitters over tariffs and trade friction persist, the domestic economy is adapting by capturing some of the supply chain shifts. The net effect on Indian equities has been a sector rotation rather than an across-the-board selloff – export-oriented industries (like IT) might face pressure, but inward-facing sectors (banks, autos, consumer goods, infrastructure, electronics manufacturing) have shown resilience.

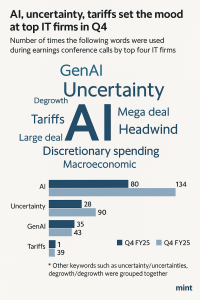

- AI Disruptions and Technological Change: The breakneck advances in artificial intelligence are a double-edged sword for markets. While there is excitement around AI-driven productivity and new business models, AI is also seen as a disruptive force that could displace jobs and upend traditional industries. There is concern that AI could put “40–50% of white-collar Indian jobs” at risk over the next decade, which understandably made investors skittish toward IT stocks in recent months. From an investor standpoint, the market is currently repricing tech sector valuations to reflect these uncertainties – we’ve seen a pullback in IT equity prices. The likely scenario is a period of adjustment, after which productivity gains from AI could start enhancing corporate earnings.

- Slowdown in IT Hiring and Earnings: Hand-in-hand with the above, India’s export-oriented IT services giants have hit a soft patch. Global economic slowing and automation trends have led to hiring freezes and spending cuts in the tech sector. Deal renewals with overseas clients are stalling, and revenue growth for IT companies has decelerated. The weight of IT in the Nifty50 index has fallen to ~10%, a 17-year low, reflecting these headwinds. From November to now, Indian IT stocks have significantly underperformed the broader market – for example, even as the Nifty 50 index eked out modest gains, the Nifty IT index is down around 12% over the same period. Such divergence signals investors rotating away from sectors facing structural challenges.

- Importantly, the broader market has been relatively resilient despite IT’s slump. Other sectors – banking, infrastructure, manufacturing, energy – have picked up the slack. This underscores how markets adapt: rather than a blanket downturn, we see a re-pricing within the market. Indian equities are digesting the IT slowdown by reallocating capital to areas with stronger near-term prospects. Additionally, the absence of excessive leverage or bubbles in the system has meant that the correction in one sector hasn’t infected the whole market. Corporate balance sheets are healthy, and banks are well-capitalized, helping maintain overall market stability. Current challenges have introduced pockets of volatility and a more selective risk appetite, but they have not derailed India’s long-term growth story.

Crucially, domestic investors have emerged as a stabilizing force during these turbulent times. Regular SIP (Systematic Investment Plan) contributions into mutual funds continue unabated through ups and downs – SIP inflows hit an annualized ~$20 billion, making domestic retail investors the largest market participants now. Even as institutional investors fret over trade wars or AI, domestic money is opportunistically accumulating stocks at lower prices, laying the groundwork for the next recovery.

“But investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

Benjamin Graham.

Turning Turbulence into Opportunity – The Long-Term View

- Anchor to a robust investment process and resist the urge to make emotional, knee-jerk reactions. As legendary investor Cliff Asness put it, success comes from “sticking to [the strategy] like grim death during the tougher times”.

- Second, make tactical adjustments without style drift. This means we can re-allocate our portfolios in response to evolving conditions, but we do so while keeping the core philosophy intact.

- Finally, maintain a long-term horizon. In the middle of a downturn, it’s difficult to see the light at the end of the tunnel, but remember that earnings cycles turn, and investor sentiment eventually heals. By the time the crowd realizes that “this too shall pass,” markets have often already moved up.

Performance

Bruce Berkowitz

After an excellent 23-24, the first 6 months of FY 24-25 carried on the momentum. But it was not to be. October brought with it turbulence and a shift in market sentiment. And the second half resulted in giving back most gains.

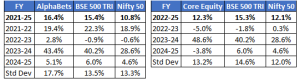

In our AlphaBets strategy, if we look at our longer-term performance, we are maintaining our outperformance over the benchmark and bettering the original benchmark which was Nifty 50 by almost 6%. It gave positive returns 4th year in a row in spite of uncertain and volatile times.

Core Equity is taking some time to settle down, but it has still held up despite having a longer rebalance period (which is a quarter) compared to a shorter rebalance period for AlphaBets. We have incorporated an EWS (early warning system) in our Core Equity strategy this quarter where we monitor the portfolio every week and take action if appropriate.

*The performance-related information provided herein is not verified by SEBI

Also both strategies complement each other as Core Equity has a large cap tilt and AlphaBets has a mid and small cap tilt. Some factors like Low Volatility played spoiled sport in the turbulent period of Oct-Dec 24 and did not act as per its label. These times remind us that factors are not silver bullets especially if we look at short-term performance.

Year Ahead – Risks and Opportunities

It promises to be a very interesting year ahead with tariffs, recessions, wars and interest rates to deal with. Markets will however climb this wall of worry. We will tune the noise out and follow our process and that has served us well in the past.

Stay safe and take care. Thank you for investing with us.

Regards,

Anish and QED Capital Team, May 2025

To know more about our investment philosophy and strategies, please share your details on https://qedcap.com/contact/

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing. The performance-related information provided herein is not verified by SEBI